Question: PLEASE ONLY ANSWER PART C WHICH IS HIGHLIGHTED Suppose a current 3-month interest rate is 4.05%. The cash prices of six-month and ninemonth Treasury bills

PLEASE ONLY ANSWER PART C WHICH IS HIGHLIGHTED

PLEASE ONLY ANSWER PART C WHICH IS HIGHLIGHTED

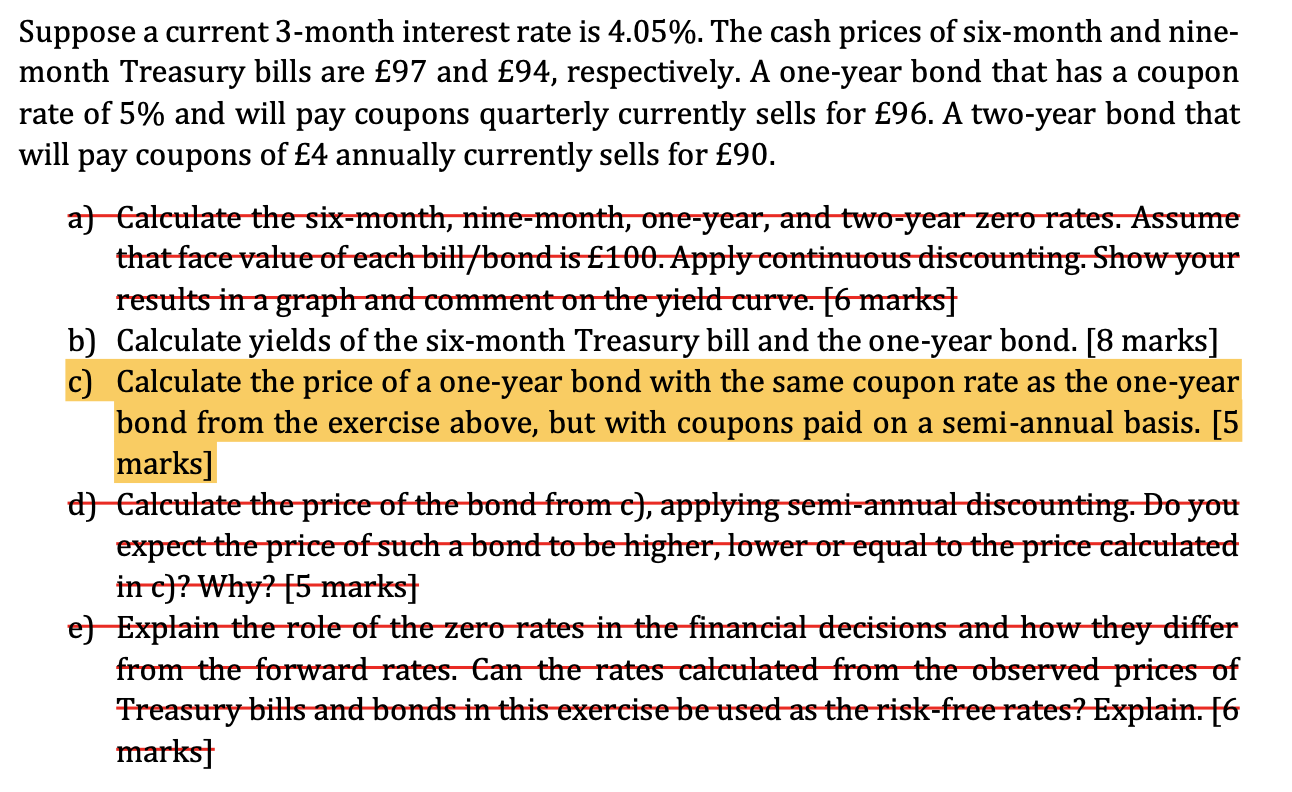

Suppose a current 3-month interest rate is 4.05%. The cash prices of six-month and ninemonth Treasury bills are 97 and 94, respectively. A one-year bond that has a coupon rate of 5% and will pay coupons quarterly currently sells for 96. A two-year bond that will pay coupons of 4 annually currently sells for 90. a) Calculate the six-month, nine-month, one-year, and two-year zero rates. Assume that face value of each bill/bond is 100. Apply continuous discounting. Show your results in a graph and comment on the yietd curve. [ 6 marks] b) Calculate yields of the six-month Treasury bill and the one-year bond. [8 marks] c) Calculate the price of a one-year bond with the same coupon rate as the one-year bond from the exercise above, but with coupons paid on a semi-annual basis. [5 marks] d) Calculate the price of the bond from c), applying semi-annual discounting. Do you expect the price of such a bond to be higher, lower or equal to the price catculated in c)? Why? [5 marks] e) Explain the role of the zero rates in the financial decisions and how they differ from the forward rates. Can the rates catculated from the observed prices of Treasury bills and bonds in this exercise be used as the risk-free rates? Explain. [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts