Question: PLEASE ONLY ANSWER QUESTION # 4 ( i have included questions 1 - 3 with the answers in case you need them to answer question

PLEASE ONLY ANSWER QUESTION #i have included questions with the answers in case you need them to answer question but please only answer question See attached the picture of what you need to provide for question

What is the value of a year, $ par value bond with a annual coupon if its required return is answer: $

What is the value of a coupon bond that is otherwise identical to the bond described in Would we now have a discount or a premium bond? answer: $

What is the value of a coupon bond with these characteristics? Would we now have a discount or a premium bond? answer:

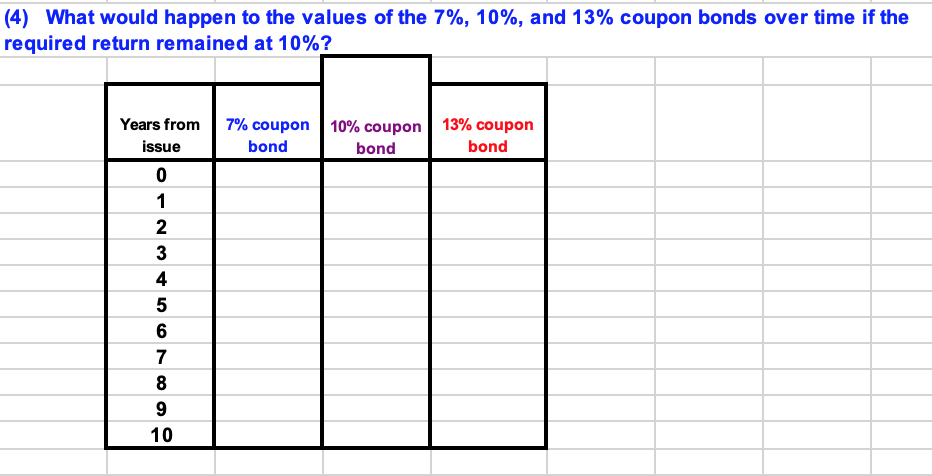

What would happen to the values of the and coupon bonds over time if the required return remained at

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock