Question: please only answer question e . = Assume that: The spot rates for 6 months, 1 year, and 2 years are (0.5) = 8% ,

please only answer question e

please only answer question e

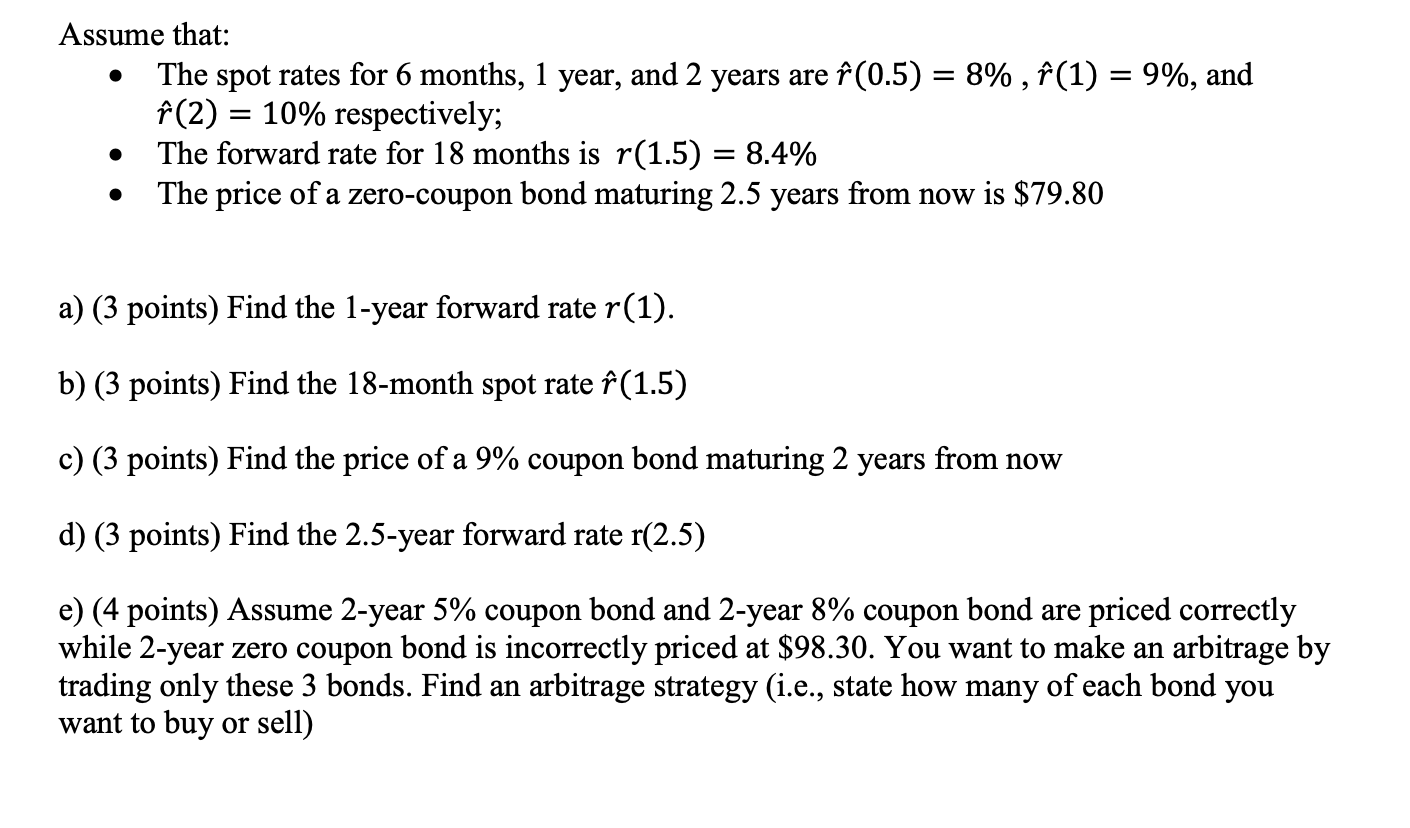

. = Assume that: The spot rates for 6 months, 1 year, and 2 years are (0.5) = 8% , f(1) = 9%, and (2) = 10% respectively; The forward rate for 18 months is r(1.5) = 8.4% The price of a zero-coupon bond maturing 2.5 years from now is $79.80 = = . a) (3 points) Find the 1-year forward rate r(1). b) (3 points) Find the 18-month spot rate (1.5) c) (3 points) Find the price of a 9% coupon bond maturing 2 years from now d) (3 points) Find the 2.5-year forward rate r(2.5) e) (4 points) Assume 2-year 5% coupon bond and 2-year 8% coupon bond are priced correctly while 2-year zero coupon bond is incorrectly priced at $98.30. You want to make an arbitrage by trading only these 3 bonds. Find an arbitrage strategy (i.e., state how many of each bond you want to buy or sell) Specific assignment instructions: All interest rates are annual interest rates with semi-annual compounding. All coupon rates are annual rates paid semi-annually. All bonds have $100 face values. Keep at least 6 decimal digits in all your calculation and answers unless specified otherwise. Show your work!!! Write down the equations you are using and then write down the same equations with appropriate numbers plugged in. If your work is clear but you make an arithmetic mistake, you will receive generous partial credit; however, if the work is unclear or missing, a significant penalty may be applied even if the answer is correct. . = Assume that: The spot rates for 6 months, 1 year, and 2 years are (0.5) = 8% , f(1) = 9%, and (2) = 10% respectively; The forward rate for 18 months is r(1.5) = 8.4% The price of a zero-coupon bond maturing 2.5 years from now is $79.80 = = . a) (3 points) Find the 1-year forward rate r(1). b) (3 points) Find the 18-month spot rate (1.5) c) (3 points) Find the price of a 9% coupon bond maturing 2 years from now d) (3 points) Find the 2.5-year forward rate r(2.5) e) (4 points) Assume 2-year 5% coupon bond and 2-year 8% coupon bond are priced correctly while 2-year zero coupon bond is incorrectly priced at $98.30. You want to make an arbitrage by trading only these 3 bonds. Find an arbitrage strategy (i.e., state how many of each bond you want to buy or sell) Specific assignment instructions: All interest rates are annual interest rates with semi-annual compounding. All coupon rates are annual rates paid semi-annually. All bonds have $100 face values. Keep at least 6 decimal digits in all your calculation and answers unless specified otherwise. Show your work!!! Write down the equations you are using and then write down the same equations with appropriate numbers plugged in. If your work is clear but you make an arithmetic mistake, you will receive generous partial credit; however, if the work is unclear or missing, a significant penalty may be applied even if the answer is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts