Question: Please only answer the following question if you are absolutely sure about the answers Thank you in advance. ANSWER THE FOLLOWING QUESTION (A) Suppose National

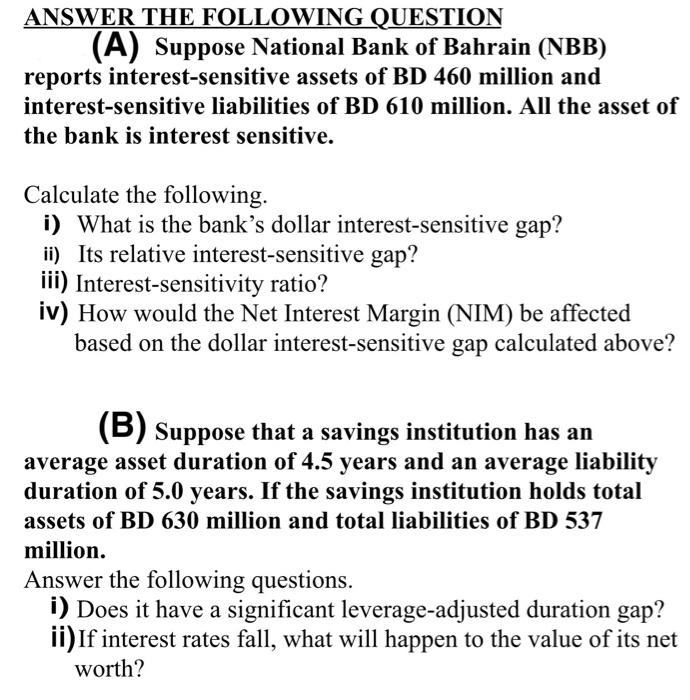

ANSWER THE FOLLOWING QUESTION (A) Suppose National Bank of Bahrain (NBB) reports interest-sensitive assets of BD 460 million and interest-sensitive liabilities of BD 610 million. All the asset of the bank is interest sensitive. Calculate the following. i) What is the bank's dollar interest-sensitive gap? ii) Its relative interest-sensitive gap? iii) Interest-sensitivity ratio? iv) How would the Net Interest Margin (NIM) be affected based on the dollar interest-sensitive gap calculated above? (B) Suppose that a savings institution has an average asset duration of 4.5 years and an average liability duration of 5.0 years. If the savings institution holds total assets of BD 630 million and total liabilities of BD 537 million. Answer the following questions. i) Does it have a significant leverage-adjusted duration gap? ii) If interest rates fall, what will happen to the value of its net worth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts