Question: Please only answer this question if you are sure you are correct. Thank you so much! You have $10,000 and you face the following investment

Please only answer this question if you are sure you are correct. Thank you so much!

Please only answer this question if you are sure you are correct. Thank you so much!

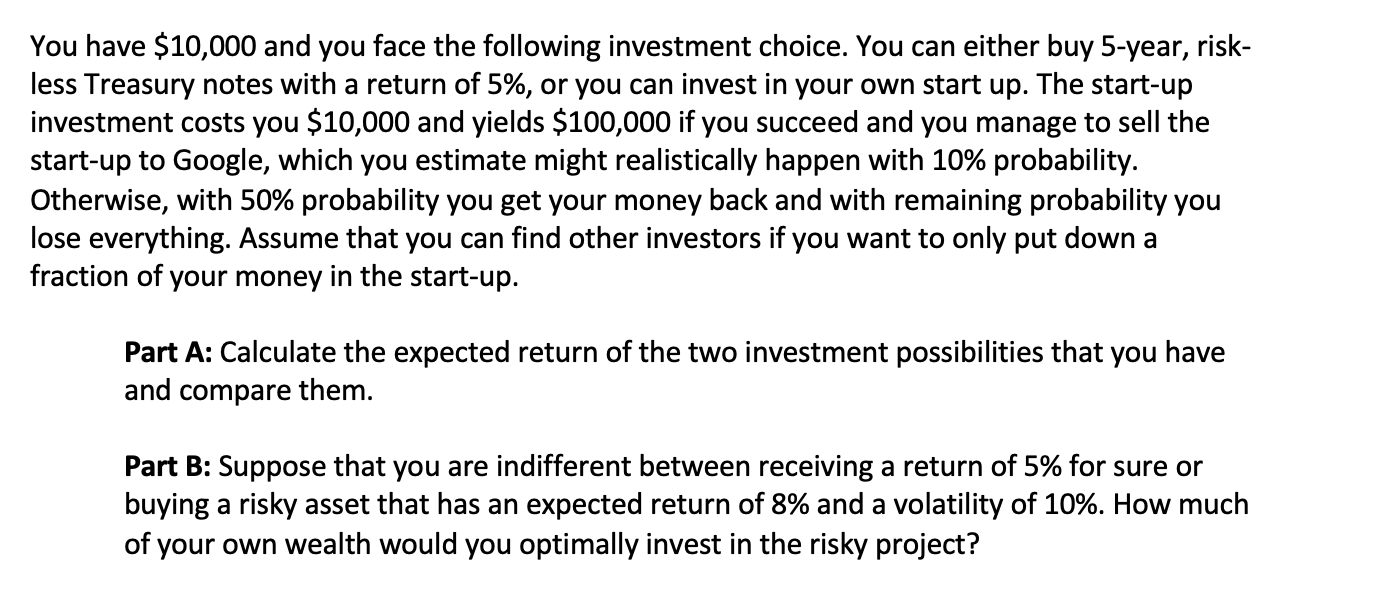

You have $10,000 and you face the following investment choice. You can either buy 5-year, risk- less Treasury notes with a return of 5%, or you can invest in your own start up. The start-up investment costs you $10,000 and yields $100,000 if you succeed and you manage to sell the start-up to Google, which you estimate might realistically happen with 10% probability. Otherwise, with 50% probability you get your money back and with remaining probability you lose everything. Assume that you can find other investors if you want to only put down a fraction of your money in the start-up. Part A: Calculate the expected return of the two investment possibilities that you have and compare them. Part B: Suppose that you are indifferent between receiving a return of 5% for sure or buying a risky asset that has an expected return of 8% and a volatility of 10%. How much of your own wealth would you optimally invest in the risky project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts