Question: PLEASE ONLY ANSWER USING EXCEL FORMULAS/CELLS - DO NOT GIVE NUMBERS AS THE ANSWER. Operating cash flow and leverage Excel FILE HOME INSERT PAGE FORMULAS

PLEASE ONLY ANSWER USING EXCEL FORMULAS/CELLS - DO NOT GIVE NUMBERS AS THE ANSWER.

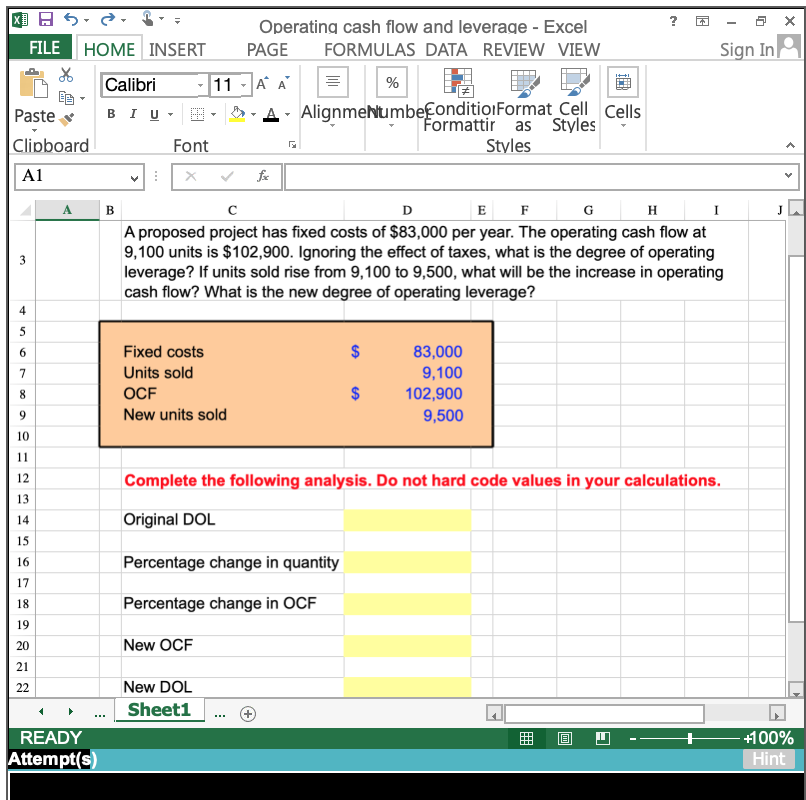

Operating cash flow and leverage Excel FILE HOME INSERT PAGE FORMULAS DATA REVIEW VIEW Sign In Calibri B I U . D.A. AlignmeNumbeEonditio|Format Cell Cells Paste ormattir as Styles- Styles Clipboard Font A1 A proposed project has fixed costs of $83,000 per year. The operating cash flow at 9,100 units is $102,900. Ignoring the effect of taxes, what is the degree of operating leverage? If units sold rise from 9,100 to 9,500, what will be the increase in operating cash flow? What is the new degree of operating leverage? 83,000 9,100 102,900 9,500 Fixed costs Units sold OCF New units sold Complete the following analysis. Do not hard code values in your calculations. Original DOL Percentage change in quantity Percentage change in OCF New OCF New DOL 15 18 19 20 21 Sheet1... > +1 00% READY Attempt(s in Operating cash flow and leverage Excel FILE HOME INSERT PAGE FORMULAS DATA REVIEW VIEW Sign In Calibri B I U . D.A. AlignmeNumbeEonditio|Format Cell Cells Paste ormattir as Styles- Styles Clipboard Font A1 A proposed project has fixed costs of $83,000 per year. The operating cash flow at 9,100 units is $102,900. Ignoring the effect of taxes, what is the degree of operating leverage? If units sold rise from 9,100 to 9,500, what will be the increase in operating cash flow? What is the new degree of operating leverage? 83,000 9,100 102,900 9,500 Fixed costs Units sold OCF New units sold Complete the following analysis. Do not hard code values in your calculations. Original DOL Percentage change in quantity Percentage change in OCF New OCF New DOL 15 18 19 20 21 Sheet1... > +1 00% READY Attempt(s in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts