Question: Please only attempt if you can solve the question with proper explanation. Please do not copy from Chegg. Consider a small office building. The property

Please only attempt if you can solve the question with proper explanation. Please do not copy from Chegg.

Please only attempt if you can solve the question with proper explanation. Please do not copy from Chegg.

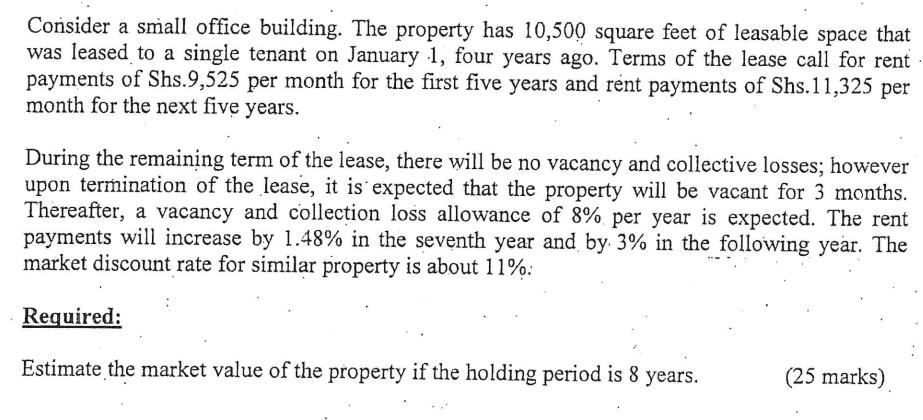

Consider a small office building. The property has 10,500 square feet of leasable space that was leased to a single tenant on January 1, four years ago. Terms of the lease call for rent payments of Shs.9,525 per month for the first five years and rent payments of Shs.11,325 per month for the next five years. During the remaining term of the lease, there will be no vacancy and collective losses; however upon termination of the lease, it is expected that the property will be vacant for 3 months. Thereafter, a vacancy and collection loss allowance of 8% per year is expected. The rent payments will increase by 1.48% in the seventh year and by 3% in the following year. The market discount rate for similar property is about 11%. Required: Estimate the market value of the property if the holding period is 8 years. (25 marks) Consider a small office building. The property has 10,500 square feet of leasable space that was leased to a single tenant on January 1, four years ago. Terms of the lease call for rent payments of Shs.9,525 per month for the first five years and rent payments of Shs.11,325 per month for the next five years. During the remaining term of the lease, there will be no vacancy and collective losses; however upon termination of the lease, it is expected that the property will be vacant for 3 months. Thereafter, a vacancy and collection loss allowance of 8% per year is expected. The rent payments will increase by 1.48% in the seventh year and by 3% in the following year. The market discount rate for similar property is about 11%. Required: Estimate the market value of the property if the holding period is 8 years. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts