Question: Please only do it if you could do it right! Thanks 2. (10 marks) In the Black-Scholes model with the risk-free rater, no dividends, and

Please only do it if you could do it right! Thanks

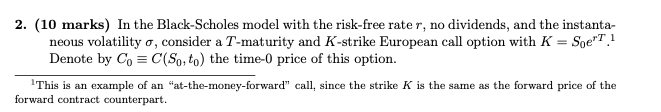

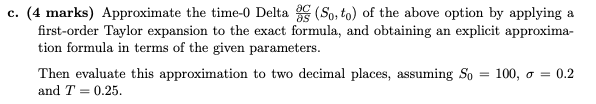

2. (10 marks) In the Black-Scholes model with the risk-free rater, no dividends, and the instanta- neous volatility o, consider a T-maturity and K-strike European call option with K = Soe"T 1 Denote by Co = C(So, to) the time-0 price of this option. This is an example of an "at-the-money-forward" call, since the strike K is the same as the forward price of the forward contract counterpart. c. (4 marks) Approximate the time-0 Delta as (So, to) of the above option by applying a first-order Taylor expansion to the exact formula, and obtaining an explicit approxima- tion formula in terms of the given parameters. Then evaluate this approximation to two decimal places, assuming So = 100, 0 = 0.2 and T = 0.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts