Question: Please only do it if you could do it right! Thanks 2. (10 marks) In the Black-Scholes model with the risk-free rater, no dividends, and

Please only do it if you could do it right! Thanks

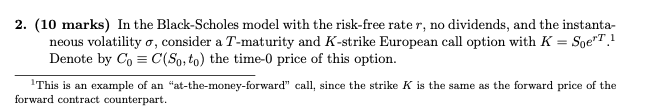

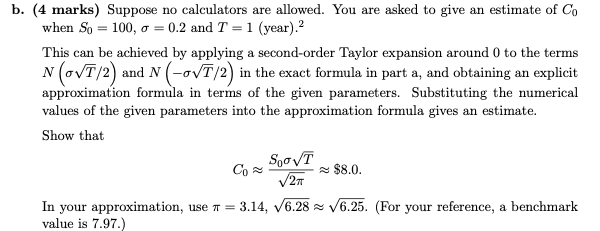

2. (10 marks) In the Black-Scholes model with the risk-free rater, no dividends, and the instanta- neous volatility o, consider a T-maturity and K-strike European call option with K = Soe"T 1 Denote by Co = C(So, to) the time-0 price of this option. This is an example of an "at-the-money-forward" call, since the strike K is the same as the forward price of the forward contract counterpart. b. (4 marks) Suppose no calculators are allowed. You are asked to give an estimate of Co when So = 100, 0 = 0.2 and T = 1 (year). This can be achieved by applying a second-order Taylor expansion around 0 to the terms N (OVT/2) and N (OVT/2) in the exact formula in part a, and obtaining an explicit approximation formula in terms of the given parameters. Substituting the numerical values of the given parameters into the approximation formula gives an estimate. Show that SVT Co $8.0. V2 In your approximation, use 1 = 3.14, V6.28 V6.25. (For your reference, a benchmark value is 7.97.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts