Question: Please only do Project 2... Figure 2-3. Net Present Value Example B D E G 1 Discount rate 10% 2 3 PROJECT 1 YEAR 1

Please only do Project 2...

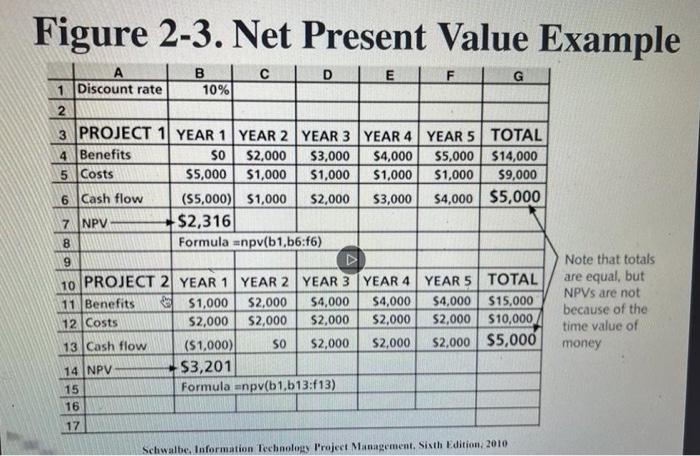

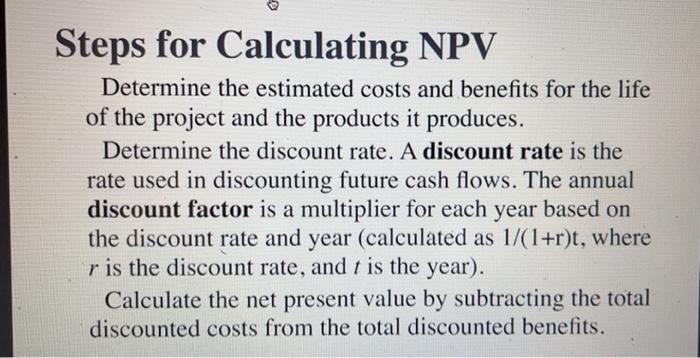

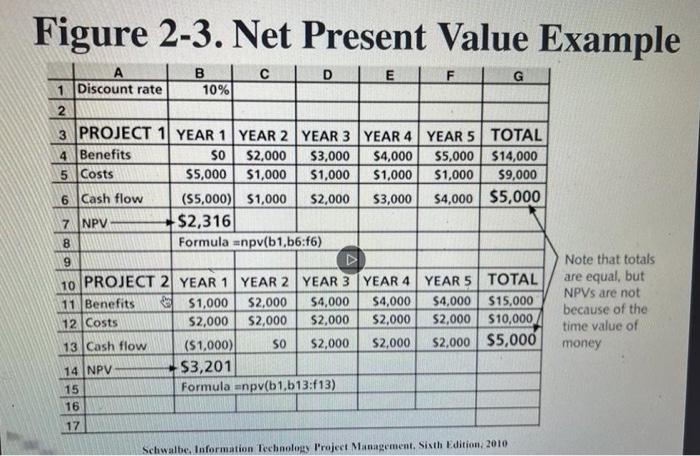

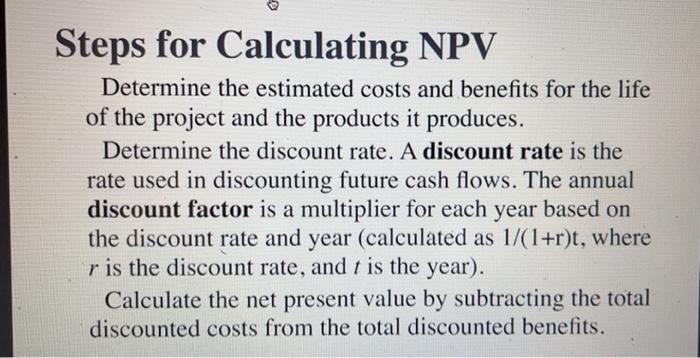

Figure 2-3. Net Present Value Example B D E G 1 Discount rate 10% 2 3 PROJECT 1 YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 TOTAL 4 Benefits SO $2,000 $3,000 $4,000 $5,000 $14,000 5 Costs $5,000 $1,000 $1,000 $1,000 $1,000 $9,000 6 Cash flow (55,000) $1,000 $2,000 53,000 $4,000 $5,000 7 NPV $2,316 8 Formula Enpv(b1,b6:f6) 9 10 PROJECT 2 YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 TOTAL 11 Benefits $1,000 $2,000 $4,000 $4,000 $4,000 $15,000 12 Costs $2,000 $2,000 $2,000 $2,000 $2,000 $10,000 13 Cash flow ($1,000) SO $2,000 $2,000 $2,000 $5,000 14 NPV $3,201 15 Formula anpv(b1.b13:13) 16 17 Note that totals are equal, but NPVs are not because of the time value of money Schwalbe. Information Technology Project Management, Sixth Edition, 2010 Steps for Calculating NPV Determine the estimated costs and benefits for the life of the project and the products it produces. Determine the discount rate. A discount rate is the rate used in discounting future cash flows. The annual discount factor is a multiplier for each year based on the discount rate and year (calculated as 1/(1+r)t, where r is the discount rate, and t is the year). Calculate the net present value by subtracting the total discounted costs from the total discounted benefits

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock