Question: Please only do question 2. (Parts a,b, and c) Please show all work! Thank you. 1. Blackstone Co. is evaluating two The project has an

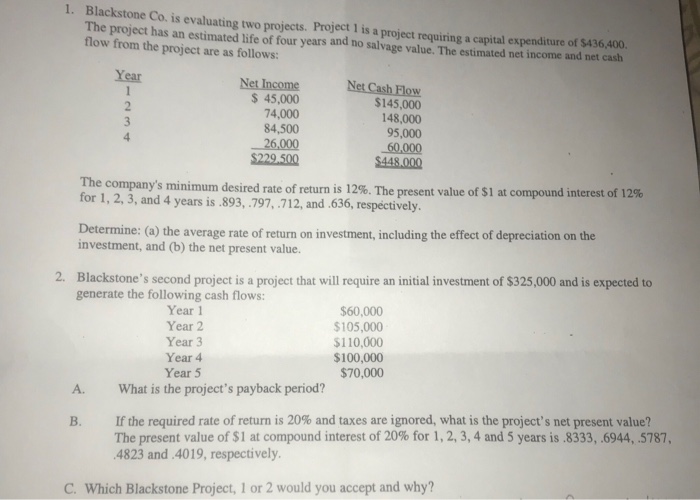

1. Blackstone Co. is evaluating two The project has an estimated life of four years and no salvage value. The estimated net income and net cash flow from the project are as follows: projects. Project 1 is a project requiring a capital expenditure of $436,400. Year Net Cash Flow $145,000 148,000 95,000 60,000 $448.000 $ 45,000 74,000 84,500 $229.500 he company's minimum desired rate of return is 12%. The for 1, 2, 3, and 4 years is.893,.797, 712, and.636, respectively. present value of SI at compound interest of 12% Determine: (a) the average rate of return on investment, including the effect of depreciation on the investment, and (b) the net present value. 2. Blackstone's second project is a project that will require an initial investment of $325,000 and is expected to generate the following cash flows: Year 1 Year 2 Year 3 Year 4 Year 5 $60,000 $105,000 $110,000 $100,000 $70,000 A. What is the project's payback period? If the required rate of return is 20% and taxes are ignored, what is the project's net present value? The present value of $1 at compound interest of 20% for 1, 2, 3, 4 and 5 years is .8333, .6944, .5787, 4823 and 4019, respectively C. which Blackstone Project, 1 or 2 would you accept and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts