Question: please only type the correct letter answer. no explanation needed 14. Which one of these condition qualifies lees a capital A The lease contains a

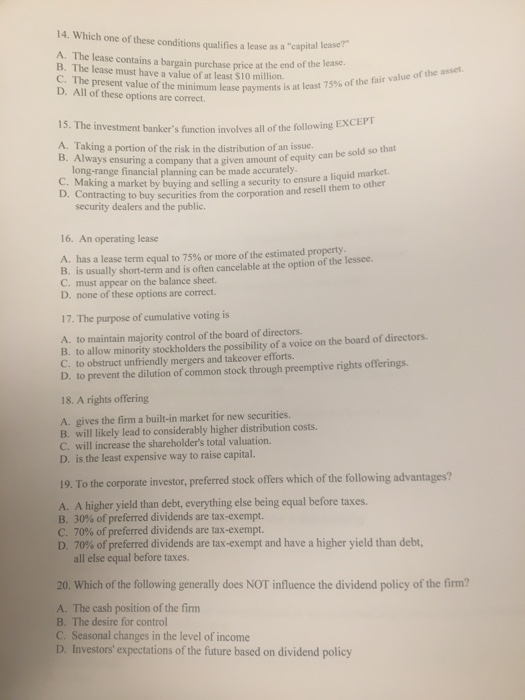

14. Which one of these condition qualifies lees a "capital A The lease contains a harcain purchase price at the end of the B. The lease must have a value of at least SIO million C. The present value of the minimum lease payment D. All of these options are correct. case payments is at least 75% of the thir value of the 13. The investment banker's function involves all of the following A Taking a portion of the risk in the distribution of an issue. B. Always ensuring a Always ensuring a company that a given amount of equity can be sold long-range financial planning can be made accurately. muid market Making a market by buying and selling a security to ensure a liquid Contracting to buy securities from the corporation and resell them security dealers and the public. 16. An operating lease A has a lease term equal to 75% or more of the estimated property. B. is usually short-term and is often cancelable at the option of the lessce. C. must appear on the balance sheet. D. none of these options are correct. 17. The purpose of cumulative voting is A. to maintain majority control of the board of directors. B. to allow minority stockholders the possibility of a voice on the board of directors. C. to obstruct unfriendly mergers and takeover efforts. D. to prevent the dilution of common stock through preemptive rights offerings, 18. A rights offering A. gives the firm a built-in market for new securities. B. will likely lead to considerably higher distribution costs. C. will increase the shareholder's total valuation. D. is the least expensive way to raise capital. 19. To the corporate investor, preferred stock offers which of the following advantages? A. A higher yield than debt, everything else being equal before taxes. B. 30% of preferred dividends are tax-exempt. C. 70% of preferred dividends are tax-exempt. D. 70% of preferred dividends are tax-exempt and have a higher yield than debt, all else equal before taxes. 20. Which of the following generally does NOT influence the dividend policy of the firm? A. The cash position of the firm B. The desire for control C. Seasonal changes in the level of income D. Investors' expectations of the future based on dividend policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts