Question: please please do this question urgently and perfectly. I will give positive rating if you solve this urgently and perfectly. highlight the main answer Question

please please do this question urgently and perfectly. I will give positive rating if you solve this urgently and perfectly. highlight the main answer

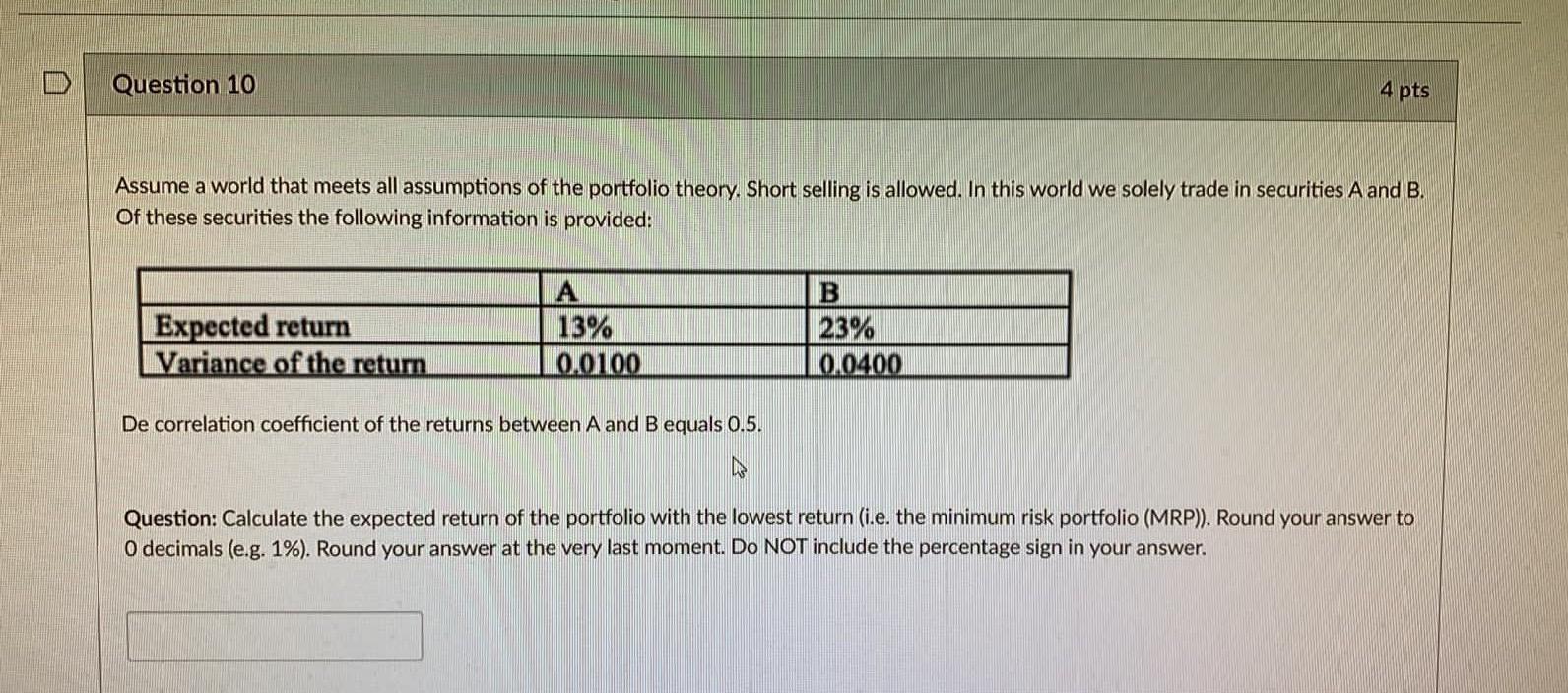

Question 10 4 pts Assume a world that meets all assumptions of the portfolio theory. Short selling is allowed. In this world we solely trade in securities A and B. Of these securities the following information is provided: Expected return Variance of the retum A 13% 0.0100 B 23% 0.0400 De correlation coefficient of the returns between A and B equals 0.5. Question: Calculate the expected return of the portfolio with the lowest return (i.e. the minimum risk portfolio (MRP)). Round your answer to O decimals (e.g. 1%). Round your answer at the very last moment. Do NOT include the percentage sign in your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts