Question: please please do this question urgently and perfectly. I will give positive rating if you solve this urgently and perfectly. highlight the main answer Question

please please do this question urgently and perfectly. I will give positive rating if you solve this urgently and perfectly. highlight the main answer

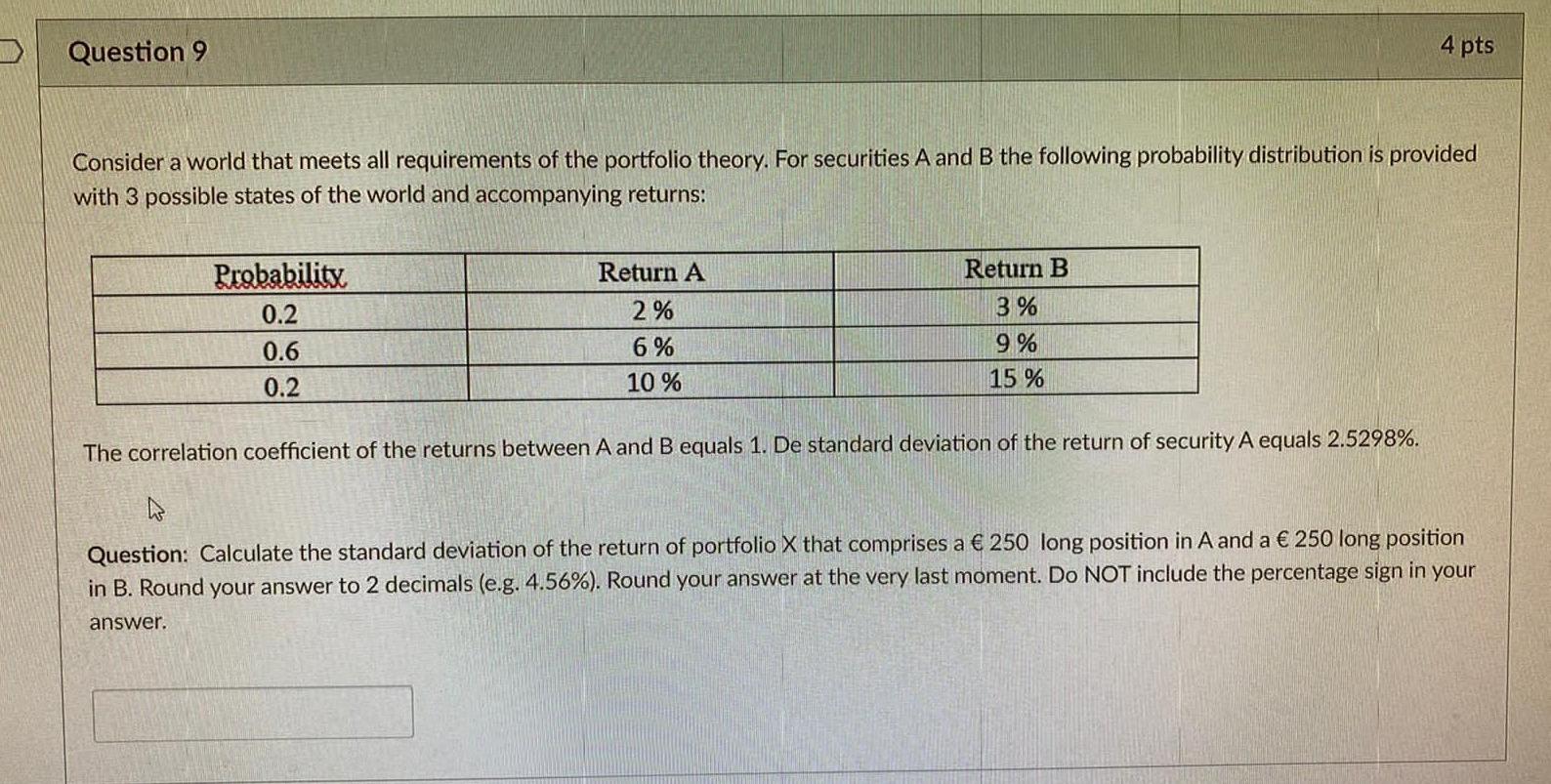

Question 9 4 pts Consider a world that meets all requirements of the portfolio theory. For securities A and B the following probability distribution is provided with 3 possible states of the world and accompanying returns: Probability 0.2 0.6 0.2 Return A 2% 6% 10 % Return B 3% 9 % 15 % The correlation coefficient of the returns between A and B equals 1. De standard deviation of the return of security A equals 2.5298%. h Question: Calculate the standard deviation of the return of portfolio X that comprises a 250 long position in A and a 250 long position in B. Round your answer to 2 decimals (e.g. 4.56%). Round your answer at the very last moment. Do NOT include the percentage sign in your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts