Question: please please help I will rate. All questions pls. 1. In Ontario, securities distributed to the public for the first time normally require a prospectus.

please please help I will rate. All questions pls.

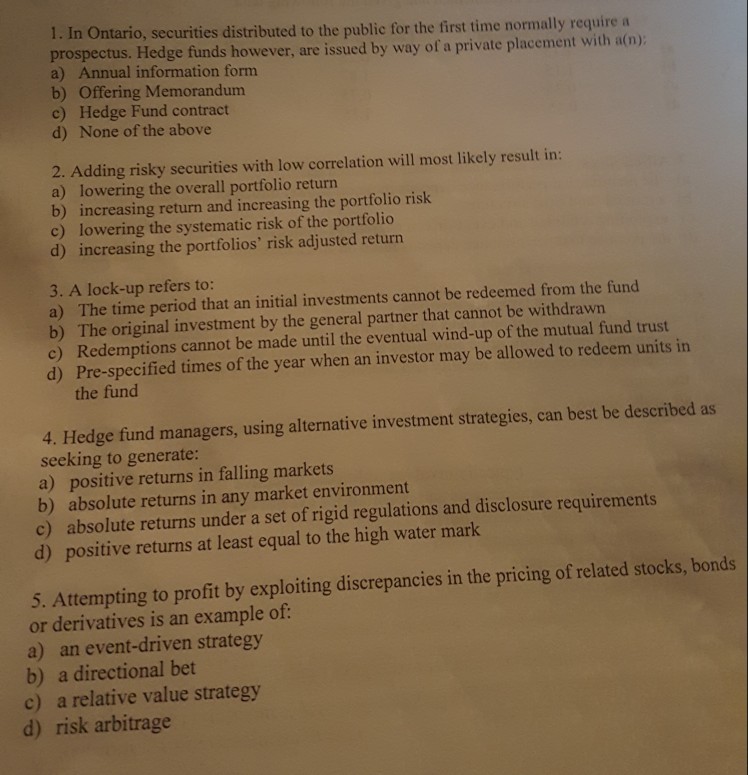

1. In Ontario, securities distributed to the public for the first time normally require a prospectus. Hedge funds however, are issued by way of a private placement with atm) a) Annual information form b) Offering Memorandum c) Hedge Fund contract d) None of the above lowering the overall portfolio return b) a) increasing return and increasing the portfolio risk c) lowering the systematic risk of the portfolio d) increasing the portfolios' risk adjusted return 3. A lock-up refers to: a) The time period that an initial investments cannot be redeemed from the fund b) The original investment by the general partner that cannot be withdrawn Redemptions cannot be made until the eventual wind-up of the mutual fund trust c) d) Pre-specified times of the year when an investor may be allowed to redeem units in the fund 4. Hedge fund managers, using alternative investment strategies, can best be described as seeking to generate: a) positive returns in falling markets b) absolute returns in any market environment c) absolute returns under a set of rigid regulations and disclosure requirements d) positive returns at least equal to the high water mark 5. Attempting to profit by exploiting discrepancies in the pricing of related stocks, bonds or derivatives is an example of a) an event-driven strategy b) a directional bet c) a relative value strategy d) risk arbitrage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts