Question: please please help I will rate definately. please please all questions. Calculate the taxable capital gain based on the following transacl&A bought 5,000 shares at

please please help I will rate definately. please please all questions.

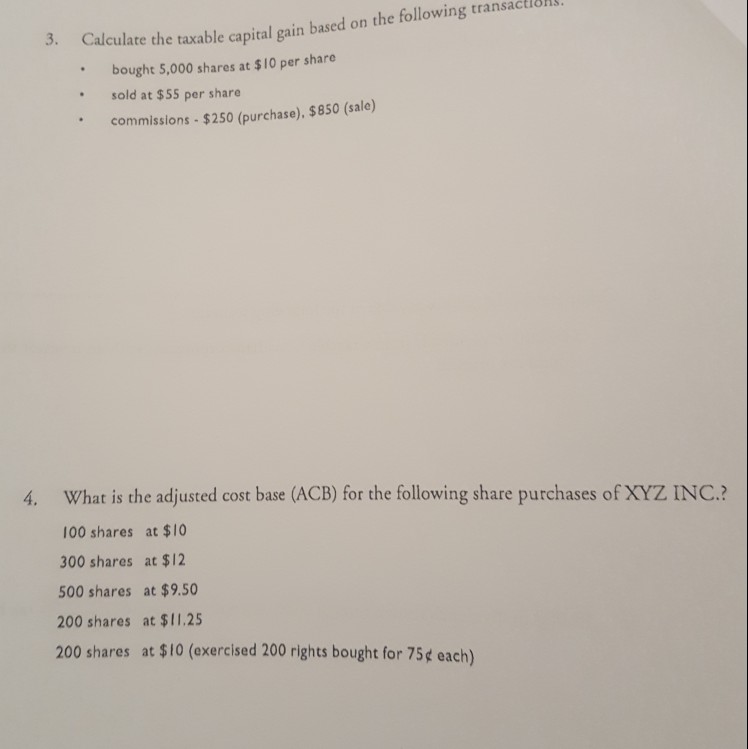

Calculate the taxable capital gain based on the following transacl&A bought 5,000 shares at $10 per sharo sold at $55 per share commissions $250 (purchase), $850 (sale) 4. What is the adjusted cost base (ACB) for the following share purchases of XYZ INC.? 100 shares at $10 300 shares at $12 500 shares at $9.50 200 shares at $11.25 200 shares at $10 (exercised 200 rights bought for 75 each)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts