Question: please please help! show all work in excel, thank you! When giving housing loans, financial institutions check, whether applicants qualify for the loan. For example,

please please help! show all work in excel, thank you!

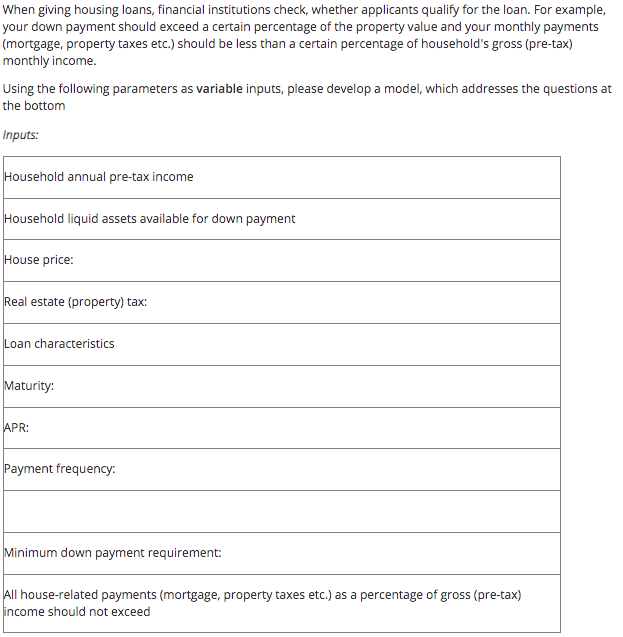

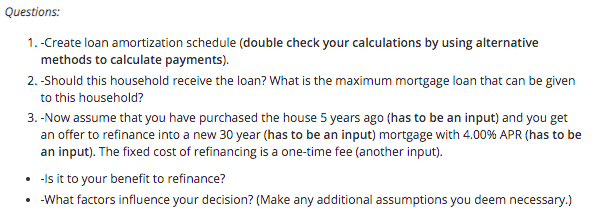

When giving housing loans, financial institutions check, whether applicants qualify for the loan. For example, your down payment should exceed a certain percentage of the property value and your monthly payments (mortgage, property taxes etc.) should be less than a certain percentage of household's gross (pre-tax) monthly income. Using the following parameters as variable inputs, please develop a model, which addresses the questions at the bottom Inputs: Household annual pre-tax income Household liquid assets available for down payment House price: Real estate (property) tax: Loan characteristics Maturity: APR: Payment frequency: Minimum down payment requirement: All house-related payments (mortgage property taxes etc.) as a percentage of gross (pre-tax) income should not exceed Questions: 1.-Create loan amortization schedule (double check your calculations by using alternative methods to calculate payments). 2. Should this household receive the loan? What is the maximum mortgage loan that can be given to this household? 3.-Now assume that you have purchased the house 5 years ago (has to be an input) and you get an offer to refinance into a new 30 year (has to be an input) mortgage with 4.00% APR (has to be an input). The fixed cost of refinancing is a one-time fee (another input). Is it to your benefit to refinance? -What factors influence your decision? (Make any additional assumptions you deem necessary.) When giving housing loans, financial institutions check, whether applicants qualify for the loan. For example, your down payment should exceed a certain percentage of the property value and your monthly payments (mortgage, property taxes etc.) should be less than a certain percentage of household's gross (pre-tax) monthly income. Using the following parameters as variable inputs, please develop a model, which addresses the questions at the bottom Inputs: Household annual pre-tax income Household liquid assets available for down payment House price: Real estate (property) tax: Loan characteristics Maturity: APR: Payment frequency: Minimum down payment requirement: All house-related payments (mortgage property taxes etc.) as a percentage of gross (pre-tax) income should not exceed Questions: 1.-Create loan amortization schedule (double check your calculations by using alternative methods to calculate payments). 2. Should this household receive the loan? What is the maximum mortgage loan that can be given to this household? 3.-Now assume that you have purchased the house 5 years ago (has to be an input) and you get an offer to refinance into a new 30 year (has to be an input) mortgage with 4.00% APR (has to be an input). The fixed cost of refinancing is a one-time fee (another input). Is it to your benefit to refinance? -What factors influence your decision? (Make any additional assumptions you deem necessary.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts