Question: PLEASE PLEASE PLEASE answer ALL FOUR questions CORRECTLY. Read the questions CAREFULLY before answering. Any WRONG or MISSING answers will be DOWNVOTED. ONLY answer if

PLEASE PLEASE PLEASE answer ALL FOUR questions CORRECTLY. Read the questions CAREFULLY before answering. Any WRONG or MISSING answers will be DOWNVOTED. ONLY answer if you're sure that your answers are CORRECT. Thank you!

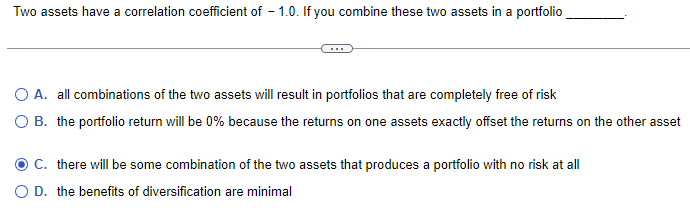

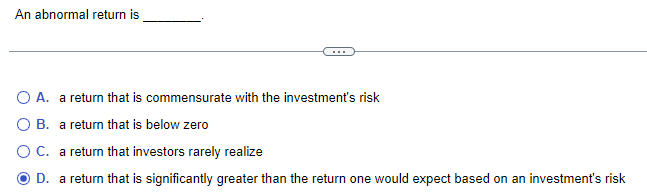

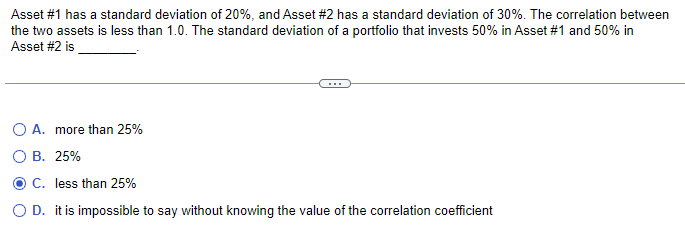

A. all combinations of the two assets will result in portfolios that are completely free of risk B. the portfolio return will be 0% because the returns on one assets exactly offset the returns on the other asset C. there will be some combination of the two assets that produces a portfolio with no risk at all D. the benefits of diversification are minimal A. a return that is commensurate with the investment's risk B. a return that is below zero C. a return that investors rarely realize D. a return that is significantly greater than the return one would expect based on an investment's risk Asset \#1 has a standard deviation of 20%, and Asset #2 has a standard deviation of 30%. The correlation between the two assets is less than 1.0 . The standard deviation of a portfolio that invests 50% in Asset \#1 and 50% in Asset \#2 is A. more than 25% B. 25% C. less than 25% A. securities, backed by American depositary shares (ADSs), that permit U.S. investors to hold shares of non - U.S. companies and trade them in U.S. markets B. securities, backed by Securities Exchange Commission (SEC), that permit U.S. investors to hold shares of non - U.S. companies and trade them in international markets C. securities, backed by Securities Exchange Commission (SEC), that permit all investors to hold shares of U.S. companies and trade them in U.S. markets D. securities, backed by American depositary shares (ADSs), that permit non - U.S. investors to hold shares of U.S. companies and trade them in U.S. markets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts