Question: please please please answer all): (Related to Checkpoint 11.1) (Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball

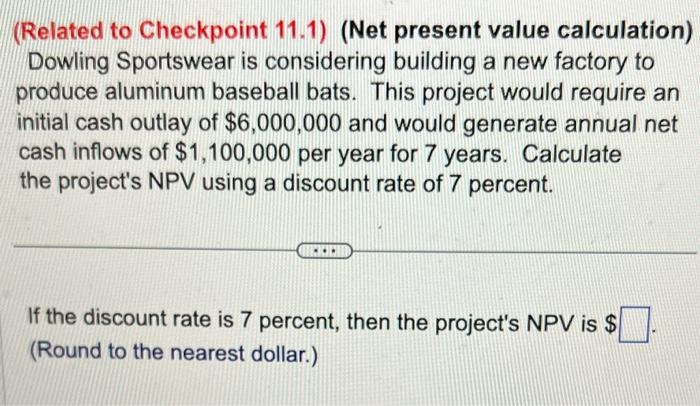

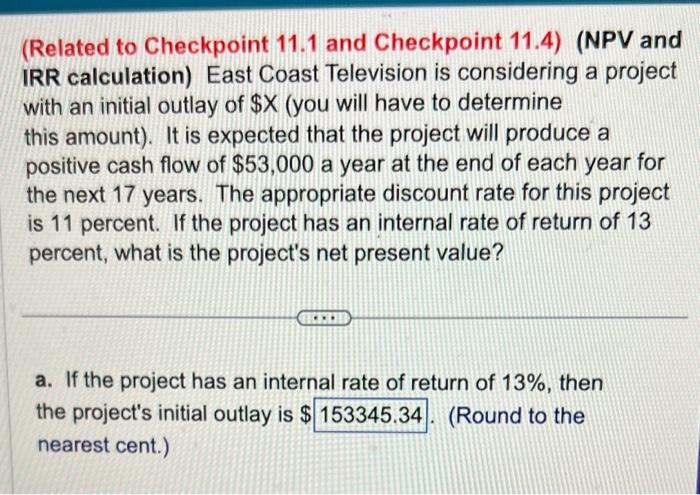

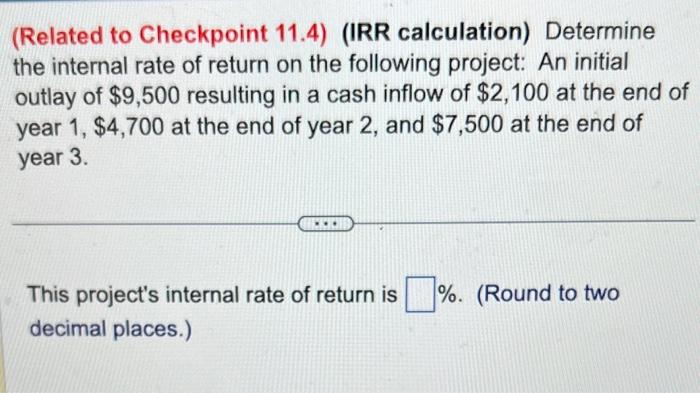

(Related to Checkpoint 11.1) (Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $6,000,000 and would generate annual net cash inflows of $1,100,000 per year for 7 years. Calculate the project's NPV using a discount rate of 7 percent. If the discount rate is 7 percent, then the project's NPV is $ (Round to the nearest dollar.) (Related to Checkpoint 11.1 and Checkpoint 11.4) (NPV and IRR calculation) East Coast Television is considering a project with an initial outlay of $X (you will have to determine this amount). It is expected that the project will produce a positive cash flow of $53,000 a year at the end of each year for the next 17 years. The appropriate discount rate for this project is 11 percent. If the project has an internal rate of return of 13 percent, what is the project's net present value? a. If the project has an internal rate of return of 13%, then the project's initial outlay is $ (Round to the nearest cent.) (Related to Checkpoint 11.4) (IRR calculation) Determine the internal rate of return on the following project: An initial outlay of $9,500 resulting in a cash inflow of $2,100 at the end of year 1,$4,700 at the end of year 2 , and $7,500 at the end of year 3. This project's internal rate of return is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts