Question: Please please please answer them all, thanks! Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium L010-5 (The

Please please please answer them all, thanks!

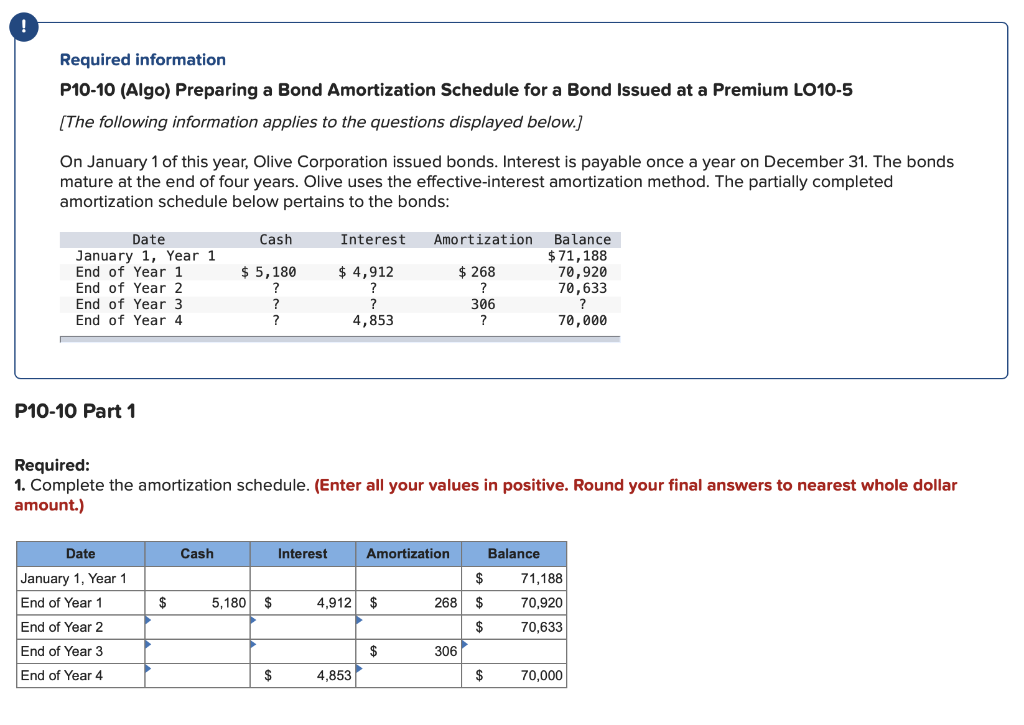

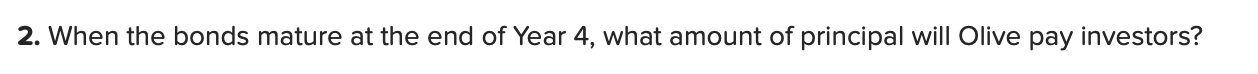

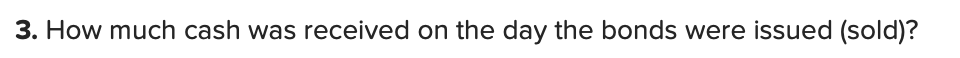

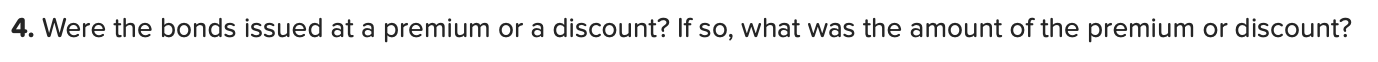

Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium L010-5 (The following information applies to the questions displayed below.) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Cash Interest Amortization Balance $ 71,188 70,920 70,633 $ 5,180 $ 4,912 Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 $ 268 ? 4,853 306 ? 70,000 P10-10 Part 1 Required: 1. Complete the amortization schedule. (Enter all your values in positive. Round your final answers to nearest whole dollar amount.) Cash Interest Amortization Balance 71,188 70,920 70,633 $ 5,180 $ 4,912 $ 268 Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 $ 306 4,853 $ 70,000 2. When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors? 3. How much cash was received on the day the bonds were issued (sold)? 4. Were the bonds issued at a premium or a discount? If so, what was the amount of the premium or discount? 5. How much cash will be disbursed for interest each period and in total over the life of the bonds? 6. What is the coupon rate? (Enter your answer as a percentage rounded to 1 decimal place (i.e. 0.123 should be entered as 12.3).) 7. What was the annual market rate of interest on the date the bonds were issued? (Enter your answer as a percentage rounded to 1 decimal place (i.e. 0.123 should be entered as 12.3).) 8. What amount of interest expense will be reported on the income statement for Year 2 and Year 3? (Round your final answers to nearest whole dollar amount.) 9. What amount will be reported on the balance sheet at the end of Year 2 and Year 3? Bonds Payable Year 2 Year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts