Question: please please please help! i always rate! Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions

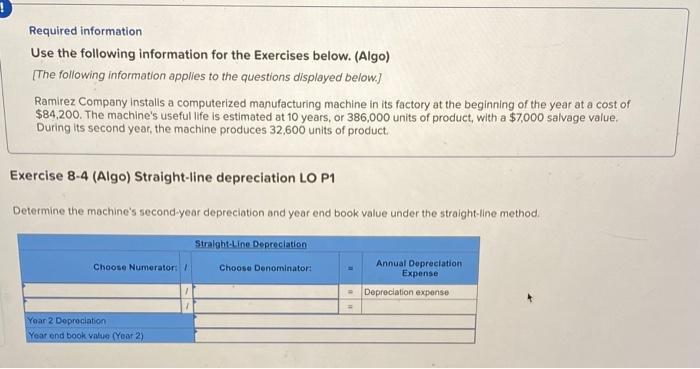

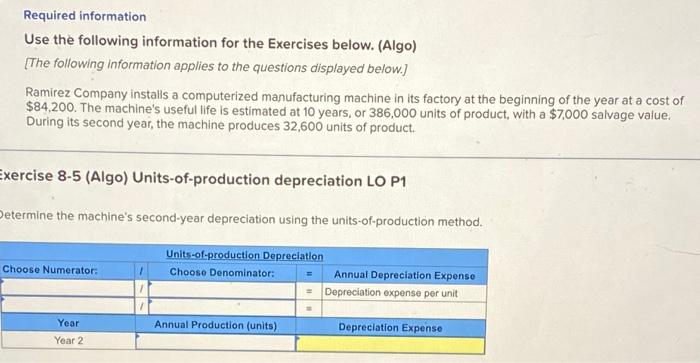

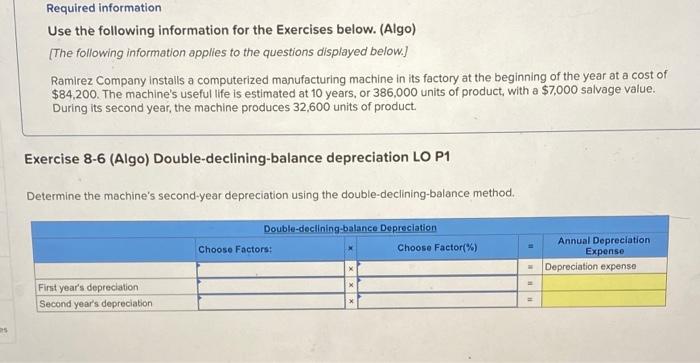

Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.) Ramirez Company Installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $84,200. The machine's useful life is estimated at 10 years, or 386,000 units of product, with a $7,000 salvage value. During its second year, the machine produces 32,600 units of product. Exercise 8-4 (Algo) Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight line method Straight-Line Depreciation Choose Numerator: Choose Denominator: Annual Depreciation Expense Depreciation expense = Year 2 Depreciation Year ond book value (Year 2) Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.) Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $84,200. The machine's useful life is estimated at 10 years, or 386,000 units of product, with a $7,000 salvage value. During its second year, the machine produces 32,600 units of product. Exercise 8-5 (Algo) Units-of-production depreciation LO P1 Determine the machine's second-year depreciation using the units-of-production method. Choose Numerator: Units-of-production Depreciation Choose Denominator: Annual Depreciation Expense = Depreciation expense per unit Annual Production (units) Year Year 2 Depreciation Expense Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below) Ramirez Company Installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $84,200. The machine's useful life is estimated at 10 years, or 386,000 units of product, with a $7,000 salvage value. During its second year, the machine produces 32,600 units of product. Exercise 8-6 (Algo) Double-declining balance depreciation LO P1 Determine the machine's second-year depreciation using the double-declining balance method. Double-declining balance Depreciation Choose Factors: Choose Factor%) Annual Depreciation Expense Depreciation expense X First year's depreciation Second year's depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts