Question: Please please please please help me ya solve with all solution 7. (a) MRCB Resources and YTL Technology have been offered the following rates per

Please please please please help me ya solve with all solution

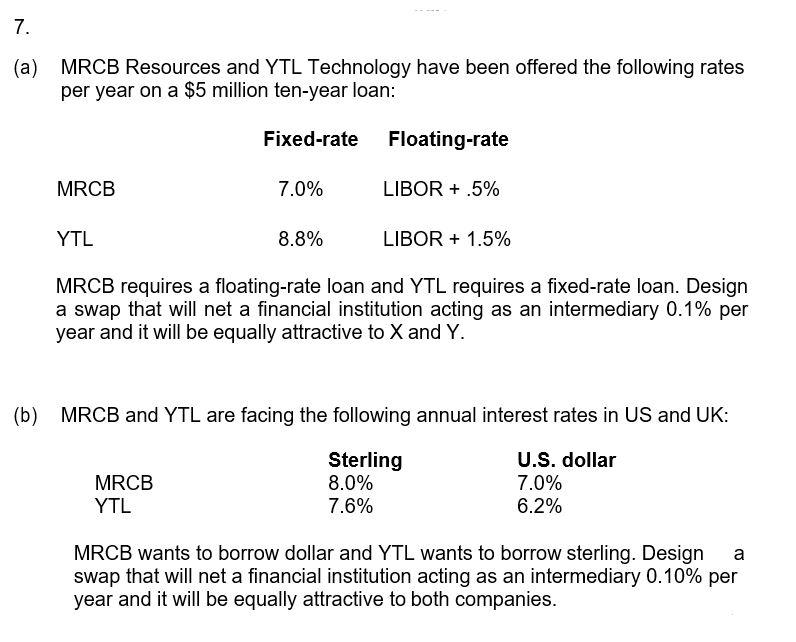

7. (a) MRCB Resources and YTL Technology have been offered the following rates per year on a $5 million ten-year loan: Fixed-rate Floating-rate MRCB 7.0% LIBOR + .5% YTL 8.8% LIBOR + 1.5% MRCB requires a floating-rate loan and YTL requires a fixed-rate loan. Design a swap that will net a financial institution acting as an intermediary 0.1% per year and it will be equally attractive to X and Y. (b) MRCB and YTL are facing the following annual interest rates in US and UK: MRCB YTL Sterling 8.0% 7.6% U.S. dollar 7.0% 6.2% MRCB wants to borrow dollar and YTL wants to borrow sterling. Design a swap that will net a financial institution acting as an intermediary 0.10% per year and it will be equally attractive to both companies. 7. (a) MRCB Resources and YTL Technology have been offered the following rates per year on a $5 million ten-year loan: Fixed-rate Floating-rate MRCB 7.0% LIBOR + .5% YTL 8.8% LIBOR + 1.5% MRCB requires a floating-rate loan and YTL requires a fixed-rate loan. Design a swap that will net a financial institution acting as an intermediary 0.1% per year and it will be equally attractive to X and Y. (b) MRCB and YTL are facing the following annual interest rates in US and UK: MRCB YTL Sterling 8.0% 7.6% U.S. dollar 7.0% 6.2% MRCB wants to borrow dollar and YTL wants to borrow sterling. Design a swap that will net a financial institution acting as an intermediary 0.10% per year and it will be equally attractive to both companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts