Question: polyproduct inc case study. dr harold kernzer 7th edition POLYPRODUCTS INC. Case Study Adapted from Dr. Harold Kerzner's Project Management A Systems Approach to Planning,

polyproduct inc case study. dr harold kernzer 7th edition

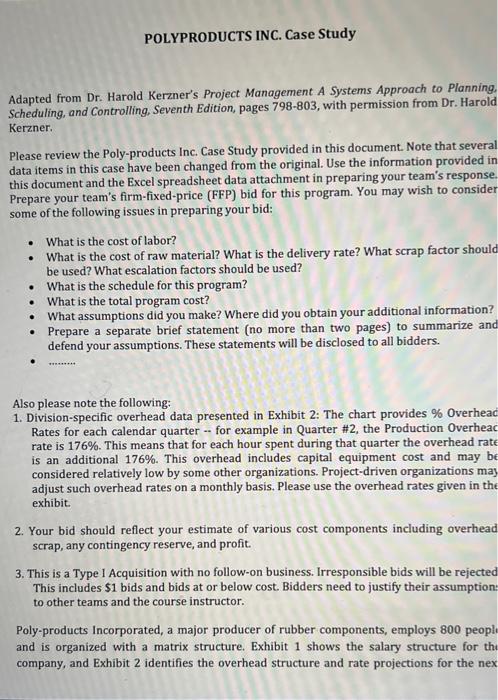

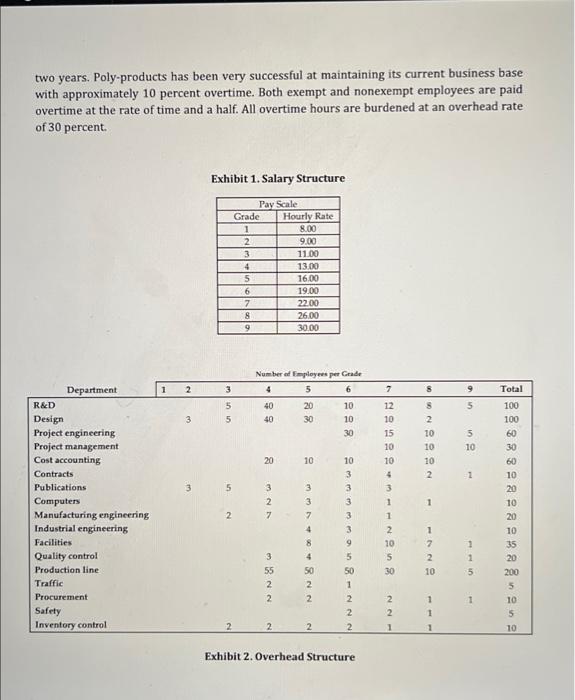

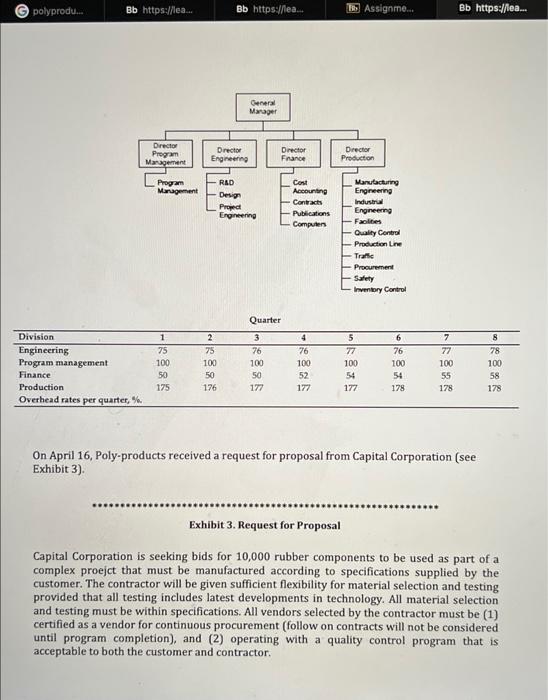

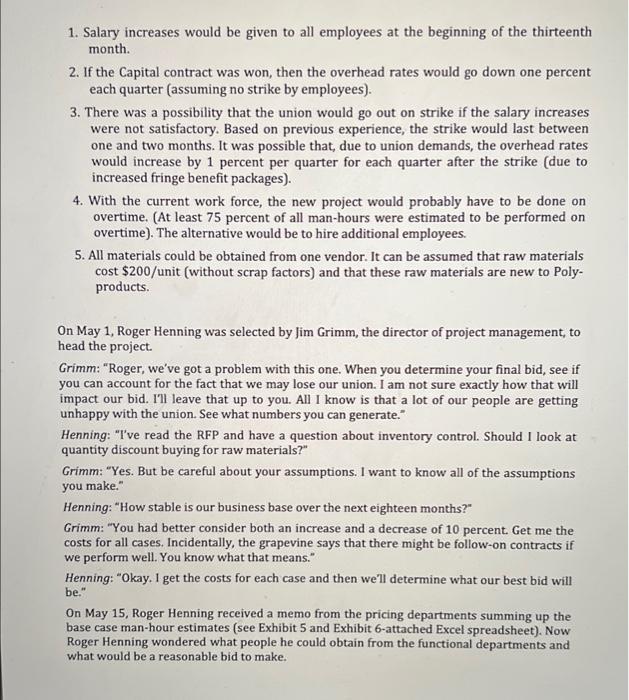

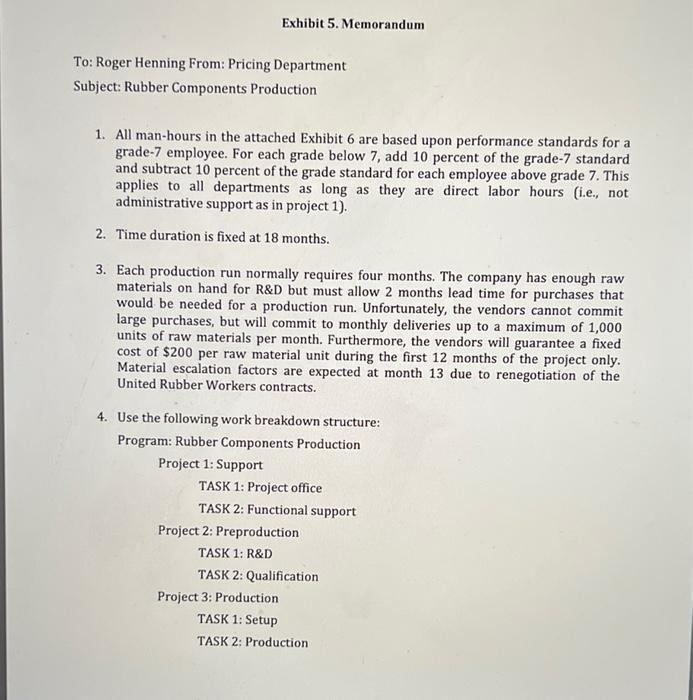

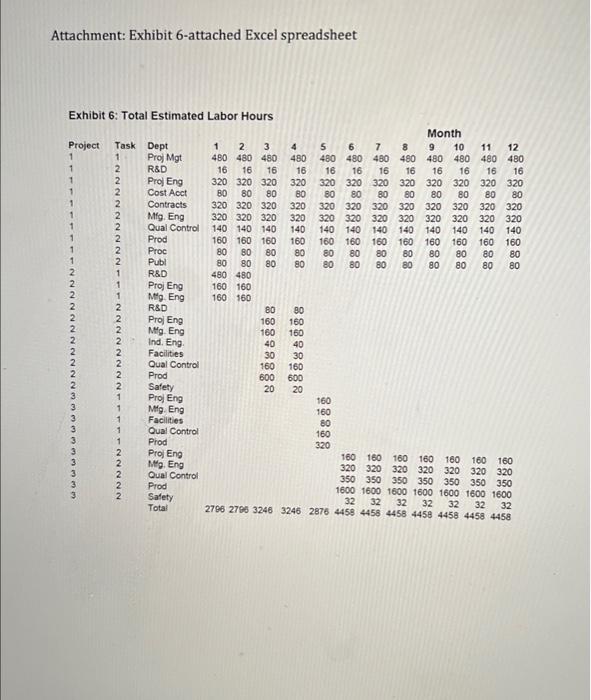

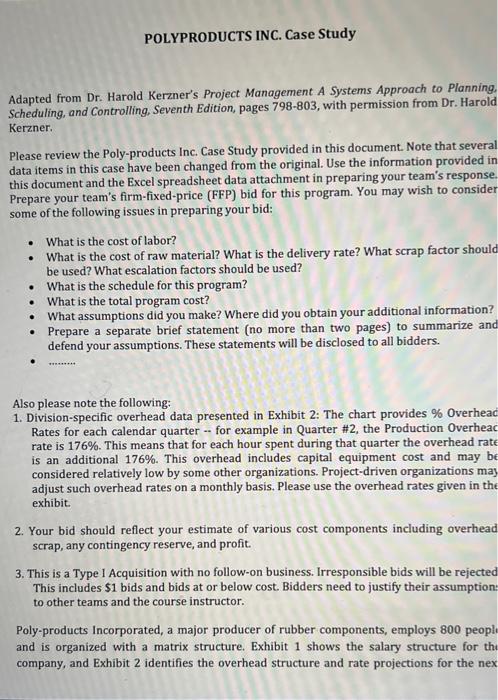

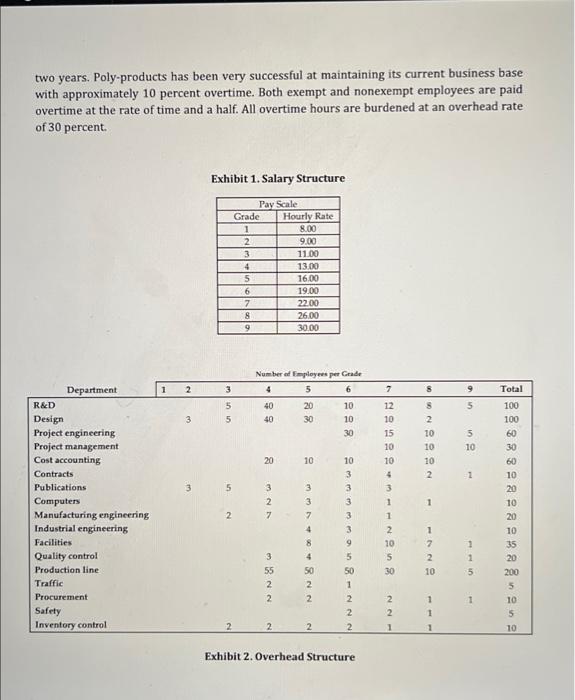

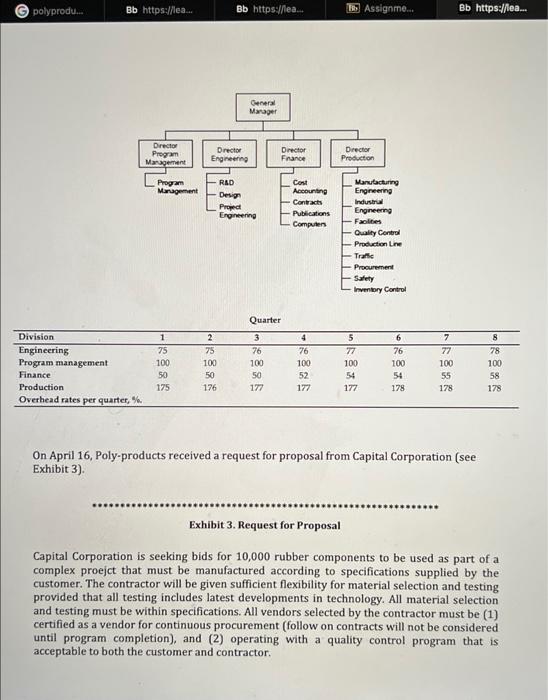

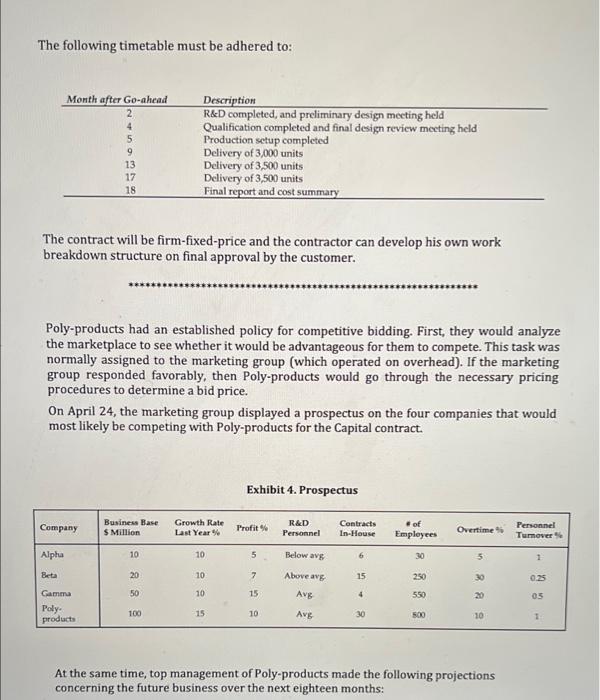

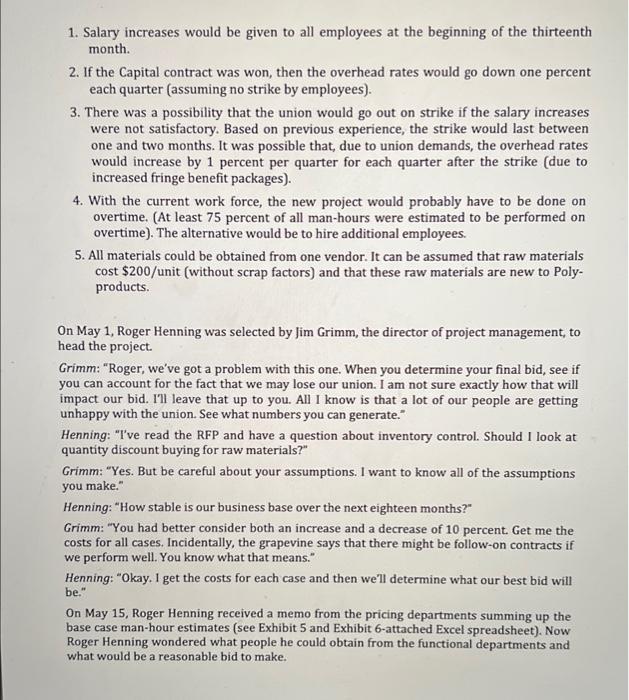

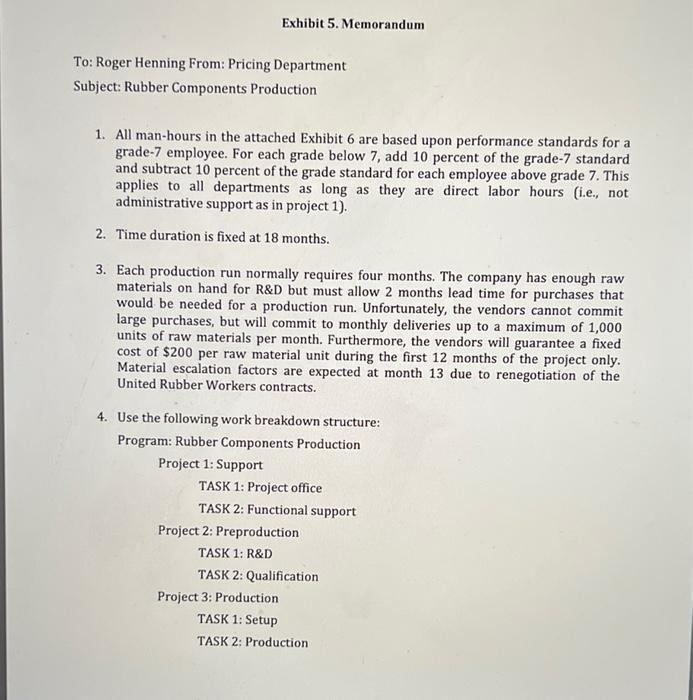

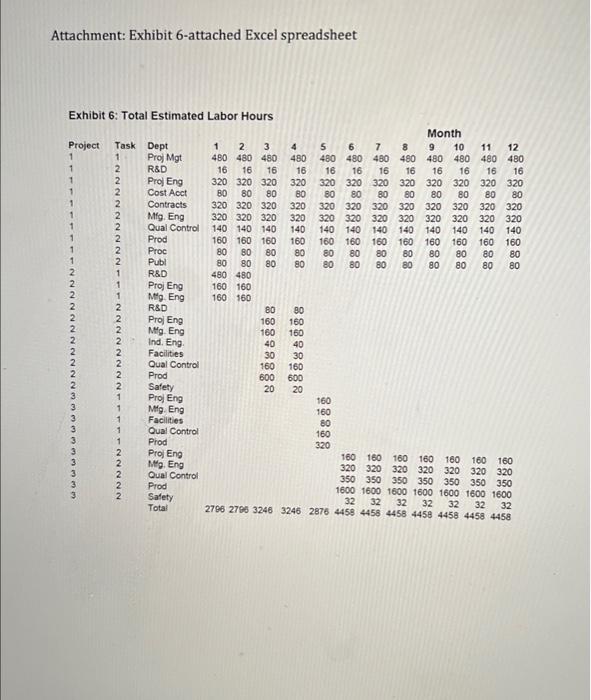

POLYPRODUCTS INC. Case Study Adapted from Dr. Harold Kerzner's Project Management A Systems Approach to Planning, Scheduling, and Controlling, Seventh Edition, pages 798-803, with permission from Dr. Harold Kerzner. Please review the Poly-products Inc. Case Study provided in this document. Note that several data items in this case have been changed from the original. Use the information provided in this document and the Excel spreadsheet data attachment in preparing your team's response Prepare your team's firm-fixed-price (FFP) bid for this program. You may wish to consider some of the following issues in preparing your bid: . What is the cost of labor? What is the cost of raw material? What is the delivery rate? What scrap factor should be used? What escalation factors should be used? What is the schedule for this program? What is the total program cost? What assumptions did you make? Where did you obtain your additional information? Prepare a separate brief statement (no more than two pages) to summarize and defend your assumptions. These statements will be disclosed to all bidders. Also please note the following: 1. Division-specific overhead data presented in Exhibit 2: The chart provides % Overhead Rates for each calendar quarter -- for example in Quarter #2, the Production Overhead rate is 176%. This means that for each hour spent during that quarter the overhead rate is an additional 176%. This overhead includes capital equipment cost and may be considered relatively low by some other organizations. Project-driven organizations may adjust such overhead rates on a monthly basis. Please use the overhead rates given in the exhibit 2. Your bid should reflect your estimate of various cost components including overhead scrap, any contingency reserve, and profit. 3. This is a Type I Acquisition with no follow-on business. Irresponsible bids will be rejected This includes $1 bids and bids at or below cost. Bidders need to justify their assumption: to other teams and the course instructor. Poly-products Incorporated, a major producer of rubber components, employs 800 people and is organized with a matrix structure. Exhibit 1 shows the salary structure for thi company, and Exhibit 2 identifies the overhead structure and rate projections for the nex two years. Poly-products has been very successful at maintaining its current business base with approximately 10 percent overtime. Both exempt and nonexempt employees are paid overtime at the rate of time and a half. All overtime hours are burdened at an overhead rate of 30 percent Exhibit 1. Salary Structure 8.00 Pay Scale Grade Hourly Rate 1 2 9.00 3 11.00 4 13.00 5 16.00 6 19.00 7 22.00 8 26.00 9 30.00 Number of Employees per Grade 5 1 2 3 4 6 7 8 5 5 5 40 40 20 30 10 10 Total 100 100 3 30 8 2 10 10 10 2 5 10 20 10 10 1 3 5 Department R&D Design Project engineering Project management Cost accounting Contracts Publications Computers Manufacturing engineering Industrial engineering Facilities Quality control Production line Traffic Procurement Safety Inventory control 3 2 7 3 3 7 1 12 10 15 10 10 4 3 1 1 2 10 5 30 3 3 2 + 4 = 4 2 2 = 2 = 2 6 8 8 8 8 8 4 = 7 NN 8 4 50 2 2 3 55 1 1 5 10 200 50 1 NN 1 NO 2 2 1 1 1 2 2 2 2 1 Exhibit 2. Overhead Structure polyprodu. Bb https://es. Bb https://ea.. E88 Assignme. Bb https://lea... General Manager Director Program Management Director Engineering Director France Director Production Program Management PI RAD Design Propea Engineering Cost Accounting Contracts Publications Computers | Manufacturing Engineering Industrial Engineering Facilities Quality Control Production Line Trafic Procurement Safety Inventory Control Quarter - - Division Engineering Program management Finance Production Overhead rates per quarter, 1 75 100 50 175 2 75 100 50 176 3 76 100 50 177 4 76 100 52 177 77 100 54 177 6 76 100 54 178 7 77 100 55 178 8 78 100 58 178 On April 16, Poly-products received a request for proposal from Capital Corporation (see Exhibit 3) Exhibit 3. Request for Proposal Capital Corporation is seeking bids for 10,000 rubber components to be used as part of a complex proejct that must be manufactured according to specifications supplied by the customer. The contractor will be given sufficient flexibility for material selection and testing provided that all testing includes latest developments in technology. All material selection and testing must be within specifications. All vendors selected by the contractor must be (1) certified as a vendor for continuous procurement (follow on contracts will not be considered until program completion), and (2) operating with a quality control program that is acceptable to both the customer and contractor. The following timetable must be adhered to: Month after Go-ahead 4 5 9 13 17 18 Description R&D completed, and preliminary design meeting held Qualification completed and final design review meeting held Production setup completed Delivery of 3,000 units Delivery of 3,500 units Delivery of 3,500 units Final report and cost summary The contract will be firm-fixed-price and the contractor can develop his own work breakdown structure on final approval by the customer. Poly-products had an established policy for competitive bidding. First, they would analyze the marketplace to see whether it would be advantageous for them to compete. This task was normally assigned to the marketing group (which operated on overhead). If the marketing group responded favorably, then Poly-products would go through the necessary pricing procedures to determine a bid price. On April 24, the marketing group displayed a prospectus on the four companies that would most likely be competing with Poly-products for the Capital contract. Exhibit 4. Prospectus Company Business Base $ Million Growth Rate Last Year Profit R&D Personnel Contracts In-House of Employees Overtime Personnel Tumover" Alpha 10 10 5 Below avg 6 30 5 1 Beta 20 10 7 Above avs 15 250 0.25 50 10 15 Avg 4 550 20 05 Gamma Poly products 100 15 10 Avg 30 500 10 At the same time, top management of Poly-products made the following projections concerning the future business over the next eighteen months: 1. Salary increases would be given to all employees at the beginning of the thirteenth month. 2. If the Capital contract was won, then the overhead rates would go down one percent each quarter (assuming no strike by employees). 3. There was a possibility that the union would go out on strike if the salary increases were not satisfactory. Based on previous experience, the strike would last between one and two months. It was possible that, due to union demands, the overhead rates would increase by 1 percent per quarter for each quarter after the strike (due to increased fringe benefit packages). 4. With the current work force, the new project would probably have to be done on overtime. (At least 75 percent of all man-hours were estimated to be performed on overtime). The alternative would be to hire additional employees. 5. All materials could be obtained from one vendor. It can be assumed that raw materials cost $200/unit (without scrap factors) and that these raw materials are new to Poly- products. On May 1, Roger Henning was selected by Jim Grimm, the director of project management, to head the project Grimm: "Roger, we've got a problem with this one. When you determine your final bid, see if you can account for the fact that we may lose our union. I am not sure exactly how that will impact our bid. I'll leave that up to you. All I know is that a lot of our people are getting unhappy with the union. See what numbers you can generate." Henning: "I've read the RFP and have a question about inventory control. Should I look quantity discount buying for raw materials?" Grimm: "Yes. But be careful about your assumptions. I want to know all of the assumptions you make." Henning: "How stable is our business base over the next eighteen months?" Grimm: "You had better consider both an increase and a decrease of 10 percent. Get me the costs for all cases. Incidentally, the grapevine says that there might be follow-on contracts if we perform well. You know what that means." Henning: "Okay. I get the costs for each case and then we'll determine what our best bid will be." On May 15, Roger Henning received a memo from the pricing departments summing up the base case man-hour estimates (see Exhibit 5 and Exhibit 6-attached Excel spreadsheet). Now Roger Henning wondered what people he could obtain from the functional departments and what would be a reasonable bid to make. Exhibit 5. Memorandum To: Roger Henning From: Pricing Department Subject: Rubber Components Production 1. All man-hours in the attached Exhibit 6 are based upon performance standards for a grade-7 employee. For each grade below 7, add 10 percent of the grade-7 standard and subtract 10 percent of the grade standard for each employee above grade 7. This applies to all departments as long as they are direct labor hours (i.e, not administrative support as in project 1). 2. Time duration is fixed at 18 months. 3. Each production run normally requires four months. The company has enough raw materials on hand for R&D but must allow 2 months lead time for purchases that would be needed for a production run. Unfortunately, the vendors cannot commit large purchases, but will commit to monthly deliveries up to a maximum of 1,000 units of raw materials per month. Furthermore, the vendors will guarantee a fixed cost of $200 per raw material unit during the first 12 months of the project only. Material escalation factors are expected at month 13 due to renegotiation of the United Rubber Workers contracts. 4. Use the following work breakdown structure: Program: Rubber Components Production Project 1: Support TASK 1: Project office TASK 2: Functional support Project 2: Preproduction TASK 1: R&D TASK 2: Qualification Project 3: Production TASK 1: Setup TASK 2: Production Attachment: Exhibit 6-attached Excel spreadsheet Exhibit 6: Total Estimated Labor Hours Project 1 N 6 ag 11 480 16 16 1 Month 7 9 10 480 16 16 16 320 320 320 80 80 320 320 320 320 320 320 320 80 888888888 1 3 480 480 16 18 320 320 320 320 BO 80 80 320 320 320 320 320 320 320 320 140 140 160 160 80 80 80 80 480 480 160 160 160 160 1 80 80 320 320 320 320 320 $88888888 8888 888 88 NNNNNNNNNNNNNNNN WWWWWWWWWWNNNNNNNNNN 88888888 89% 8888 88888 NNNNN 3246 2870 POLYPRODUCTS INC. Case Study Adapted from Dr. Harold Kerzner's Project Management A Systems Approach to Planning, Scheduling, and Controlling, Seventh Edition, pages 798-803, with permission from Dr. Harold Kerzner. Please review the Poly-products Inc. Case Study provided in this document. Note that several data items in this case have been changed from the original. Use the information provided in this document and the Excel spreadsheet data attachment in preparing your team's response Prepare your team's firm-fixed-price (FFP) bid for this program. You may wish to consider some of the following issues in preparing your bid: . What is the cost of labor? What is the cost of raw material? What is the delivery rate? What scrap factor should be used? What escalation factors should be used? What is the schedule for this program? What is the total program cost? What assumptions did you make? Where did you obtain your additional information? Prepare a separate brief statement (no more than two pages) to summarize and defend your assumptions. These statements will be disclosed to all bidders. Also please note the following: 1. Division-specific overhead data presented in Exhibit 2: The chart provides % Overhead Rates for each calendar quarter -- for example in Quarter #2, the Production Overhead rate is 176%. This means that for each hour spent during that quarter the overhead rate is an additional 176%. This overhead includes capital equipment cost and may be considered relatively low by some other organizations. Project-driven organizations may adjust such overhead rates on a monthly basis. Please use the overhead rates given in the exhibit 2. Your bid should reflect your estimate of various cost components including overhead scrap, any contingency reserve, and profit. 3. This is a Type I Acquisition with no follow-on business. Irresponsible bids will be rejected This includes $1 bids and bids at or below cost. Bidders need to justify their assumption: to other teams and the course instructor. Poly-products Incorporated, a major producer of rubber components, employs 800 people and is organized with a matrix structure. Exhibit 1 shows the salary structure for thi company, and Exhibit 2 identifies the overhead structure and rate projections for the nex two years. Poly-products has been very successful at maintaining its current business base with approximately 10 percent overtime. Both exempt and nonexempt employees are paid overtime at the rate of time and a half. All overtime hours are burdened at an overhead rate of 30 percent Exhibit 1. Salary Structure 8.00 Pay Scale Grade Hourly Rate 1 2 9.00 3 11.00 4 13.00 5 16.00 6 19.00 7 22.00 8 26.00 9 30.00 Number of Employees per Grade 5 1 2 3 4 6 7 8 5 5 5 40 40 20 30 10 10 Total 100 100 3 30 8 2 10 10 10 2 5 10 20 10 10 1 3 5 Department R&D Design Project engineering Project management Cost accounting Contracts Publications Computers Manufacturing engineering Industrial engineering Facilities Quality control Production line Traffic Procurement Safety Inventory control 3 2 7 3 3 7 1 12 10 15 10 10 4 3 1 1 2 10 5 30 3 3 2 + 4 = 4 2 2 = 2 = 2 6 8 8 8 8 8 4 = 7 NN 8 4 50 2 2 3 55 1 1 5 10 200 50 1 NN 1 NO 2 2 1 1 1 2 2 2 2 1 Exhibit 2. Overhead Structure polyprodu. Bb https://es. Bb https://ea.. E88 Assignme. Bb https://lea... General Manager Director Program Management Director Engineering Director France Director Production Program Management PI RAD Design Propea Engineering Cost Accounting Contracts Publications Computers | Manufacturing Engineering Industrial Engineering Facilities Quality Control Production Line Trafic Procurement Safety Inventory Control Quarter - - Division Engineering Program management Finance Production Overhead rates per quarter, 1 75 100 50 175 2 75 100 50 176 3 76 100 50 177 4 76 100 52 177 77 100 54 177 6 76 100 54 178 7 77 100 55 178 8 78 100 58 178 On April 16, Poly-products received a request for proposal from Capital Corporation (see Exhibit 3) Exhibit 3. Request for Proposal Capital Corporation is seeking bids for 10,000 rubber components to be used as part of a complex proejct that must be manufactured according to specifications supplied by the customer. The contractor will be given sufficient flexibility for material selection and testing provided that all testing includes latest developments in technology. All material selection and testing must be within specifications. All vendors selected by the contractor must be (1) certified as a vendor for continuous procurement (follow on contracts will not be considered until program completion), and (2) operating with a quality control program that is acceptable to both the customer and contractor. The following timetable must be adhered to: Month after Go-ahead 4 5 9 13 17 18 Description R&D completed, and preliminary design meeting held Qualification completed and final design review meeting held Production setup completed Delivery of 3,000 units Delivery of 3,500 units Delivery of 3,500 units Final report and cost summary The contract will be firm-fixed-price and the contractor can develop his own work breakdown structure on final approval by the customer. Poly-products had an established policy for competitive bidding. First, they would analyze the marketplace to see whether it would be advantageous for them to compete. This task was normally assigned to the marketing group (which operated on overhead). If the marketing group responded favorably, then Poly-products would go through the necessary pricing procedures to determine a bid price. On April 24, the marketing group displayed a prospectus on the four companies that would most likely be competing with Poly-products for the Capital contract. Exhibit 4. Prospectus Company Business Base $ Million Growth Rate Last Year Profit R&D Personnel Contracts In-House of Employees Overtime Personnel Tumover" Alpha 10 10 5 Below avg 6 30 5 1 Beta 20 10 7 Above avs 15 250 0.25 50 10 15 Avg 4 550 20 05 Gamma Poly products 100 15 10 Avg 30 500 10 At the same time, top management of Poly-products made the following projections concerning the future business over the next eighteen months: 1. Salary increases would be given to all employees at the beginning of the thirteenth month. 2. If the Capital contract was won, then the overhead rates would go down one percent each quarter (assuming no strike by employees). 3. There was a possibility that the union would go out on strike if the salary increases were not satisfactory. Based on previous experience, the strike would last between one and two months. It was possible that, due to union demands, the overhead rates would increase by 1 percent per quarter for each quarter after the strike (due to increased fringe benefit packages). 4. With the current work force, the new project would probably have to be done on overtime. (At least 75 percent of all man-hours were estimated to be performed on overtime). The alternative would be to hire additional employees. 5. All materials could be obtained from one vendor. It can be assumed that raw materials cost $200/unit (without scrap factors) and that these raw materials are new to Poly- products. On May 1, Roger Henning was selected by Jim Grimm, the director of project management, to head the project Grimm: "Roger, we've got a problem with this one. When you determine your final bid, see if you can account for the fact that we may lose our union. I am not sure exactly how that will impact our bid. I'll leave that up to you. All I know is that a lot of our people are getting unhappy with the union. See what numbers you can generate." Henning: "I've read the RFP and have a question about inventory control. Should I look quantity discount buying for raw materials?" Grimm: "Yes. But be careful about your assumptions. I want to know all of the assumptions you make." Henning: "How stable is our business base over the next eighteen months?" Grimm: "You had better consider both an increase and a decrease of 10 percent. Get me the costs for all cases. Incidentally, the grapevine says that there might be follow-on contracts if we perform well. You know what that means." Henning: "Okay. I get the costs for each case and then we'll determine what our best bid will be." On May 15, Roger Henning received a memo from the pricing departments summing up the base case man-hour estimates (see Exhibit 5 and Exhibit 6-attached Excel spreadsheet). Now Roger Henning wondered what people he could obtain from the functional departments and what would be a reasonable bid to make. Exhibit 5. Memorandum To: Roger Henning From: Pricing Department Subject: Rubber Components Production 1. All man-hours in the attached Exhibit 6 are based upon performance standards for a grade-7 employee. For each grade below 7, add 10 percent of the grade-7 standard and subtract 10 percent of the grade standard for each employee above grade 7. This applies to all departments as long as they are direct labor hours (i.e, not administrative support as in project 1). 2. Time duration is fixed at 18 months. 3. Each production run normally requires four months. The company has enough raw materials on hand for R&D but must allow 2 months lead time for purchases that would be needed for a production run. Unfortunately, the vendors cannot commit large purchases, but will commit to monthly deliveries up to a maximum of 1,000 units of raw materials per month. Furthermore, the vendors will guarantee a fixed cost of $200 per raw material unit during the first 12 months of the project only. Material escalation factors are expected at month 13 due to renegotiation of the United Rubber Workers contracts. 4. Use the following work breakdown structure: Program: Rubber Components Production Project 1: Support TASK 1: Project office TASK 2: Functional support Project 2: Preproduction TASK 1: R&D TASK 2: Qualification Project 3: Production TASK 1: Setup TASK 2: Production Attachment: Exhibit 6-attached Excel spreadsheet Exhibit 6: Total Estimated Labor Hours Project 1 N 6 ag 11 480 16 16 1 Month 7 9 10 480 16 16 16 320 320 320 80 80 320 320 320 320 320 320 320 80 888888888 1 3 480 480 16 18 320 320 320 320 BO 80 80 320 320 320 320 320 320 320 320 140 140 160 160 80 80 80 80 480 480 160 160 160 160 1 80 80 320 320 320 320 320 $88888888 8888 888 88 NNNNNNNNNNNNNNNN WWWWWWWWWWNNNNNNNNNN 88888888 89% 8888 88888 NNNNN 3246 2870

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock