Question: ** Please post a detailed explanation on how you solved the question, with all formulas and calculations. ** Q3. Gimble Inc. granted 200 stock options

** Please post a detailed explanation on how you solved the question, with all formulas and calculations. **

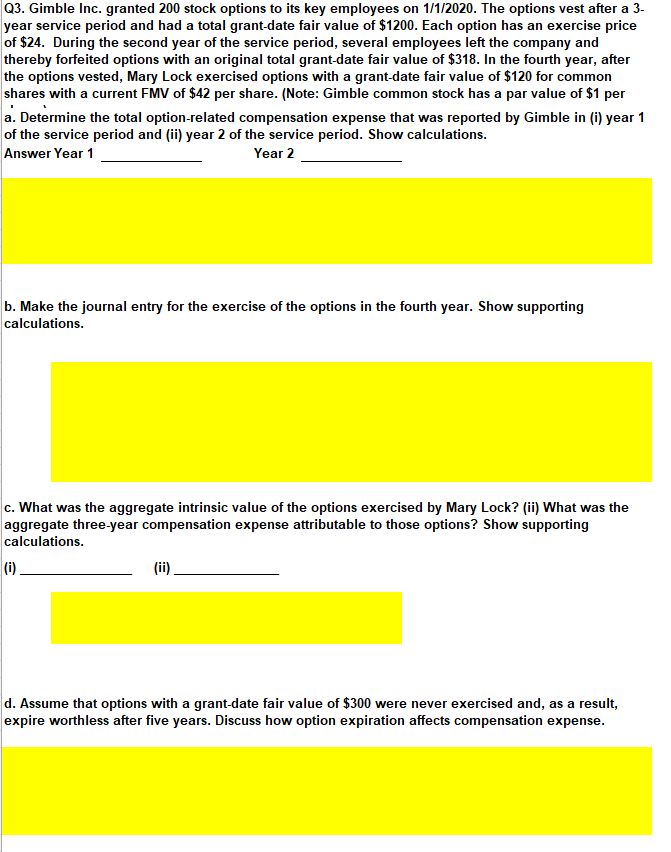

Q3. Gimble Inc. granted 200 stock options to its key employees on 1/1/2020. The options vest after a 3year service period and had a total grant-date fair value of $1200. Each option has an exercise price of $24. During the second year of the service period, several employees left the company and thereby forfeited options with an original total grant-date fair value of $318. In the fourth year, after the options vested, Mary Lock exercised options with a grant-date fair value of $120 for common shares with a current FMV of $42 per share. (Note: Gimble common stock has a par value of $1 per a. Determine the total option-related compensation expense that was reported by Gimble in (i) year 1 of the service period and (ii) year 2 of the service period. Show calculations. Answer Year 1 Year 2 b. Make the journal entry for the exercise of the options in the fourth year. Show supporting calculations. c. What was the aggregate intrinsic value of the options exercised by Mary Lock? (ii) What was the aggregate three-year compensation expense attributable to those options? Show supporting calculations. (i) (ii) d. Assume that options with a grant-date fair value of $300 were never exercised and, as a result, expire worthless after five years. Discuss how option expiration affects compensation expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts