Question: Please post a detailed explanation on how you solved the question, with all formulas and calculations. Q2. On January 01, 2021, Alex Company granted restricted

Please post a detailed explanation on how you solved the question, with all formulas and calculations.

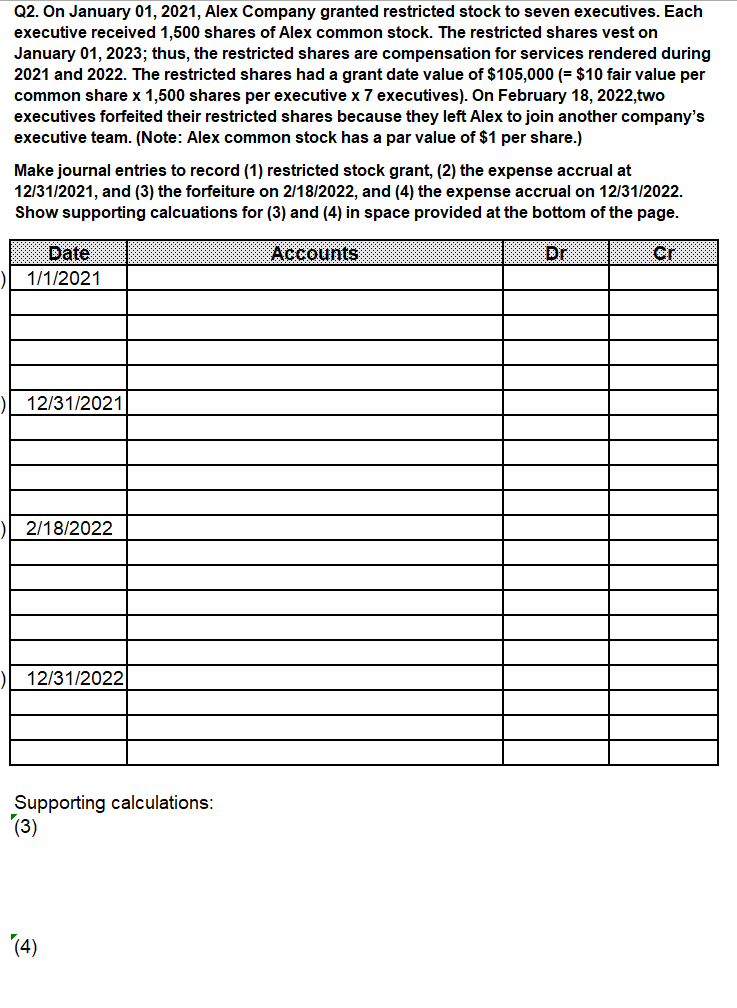

Q2. On January 01, 2021, Alex Company granted restricted stock to seven executives. Each executive received 1,500 shares of Alex common stock. The restricted shares vest on January 01, 2023; thus, the restricted shares are compensation for services rendered during 2021 and 2022 . The restricted shares had a grant date value of $105,000(=$10 fair value per common share x1,500 shares per executive x7 executives). On February 18,2022 , two executives forfeited their restricted shares because they left Alex to join another company's executive team. (Note: Alex common stock has a par value of $1 per share.) Make journal entries to record (1) restricted stock grant, (2) the expense accrual at 12/31/2021, and (3) the forfeiture on 2/18/2022, and (4) the expense accrual on 12/31/2022. Show supporting calcuations for (3) and (4) in space provided at the bottom of the page. Supporting calculations: (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts