Question: PLEASE POST STEPS AND DO NOT USE PREVIOUS ANSWERS ON CHEGG THEY ARE INCORRECT! Problem 4. On January 1, 2019. Erk, the lessee, and Betty,

PLEASE POST STEPS AND DO NOT USE PREVIOUS ANSWERS ON CHEGG THEY ARE INCORRECT!

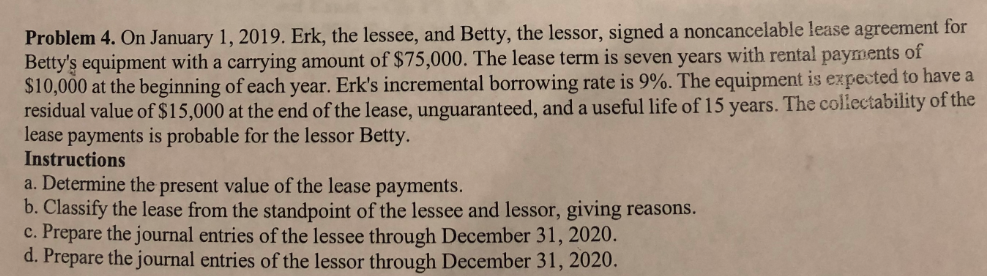

Problem 4. On January 1, 2019. Erk, the lessee, and Betty, the lessor, signed a noncancelable lease agreement for Betty's equipment with a carrying amount of $75,000. The lease term is seven years with rental payments of $10,000 at the beginning of each year. Erk's incremental borrowing rate is 9%. The equipment is expected to have a residual value of $15,000 at the end of the lease, unguaranteed, and a useful life of 15 years. The collectability of the lease payments is probable for the lessor Betty. Instructions a. Determine the present value of the lease payments. b. Classify the lease from the standpoint of the lessee and lessor, giving reasons. c. Prepare the journal entries of the lessee through December 31, 2020. d. Prepare the journal entries of the lessor through December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts