Question: PLEASE POST STEPS AND DO NOT USE PREVIOUS ANSWERS ON CHEGG THEY ARE INCORRECT! ases as a means of selling its equipment. On January 1,

PLEASE POST STEPS AND DO NOT USE PREVIOUS ANSWERS ON CHEGG THEY ARE INCORRECT!

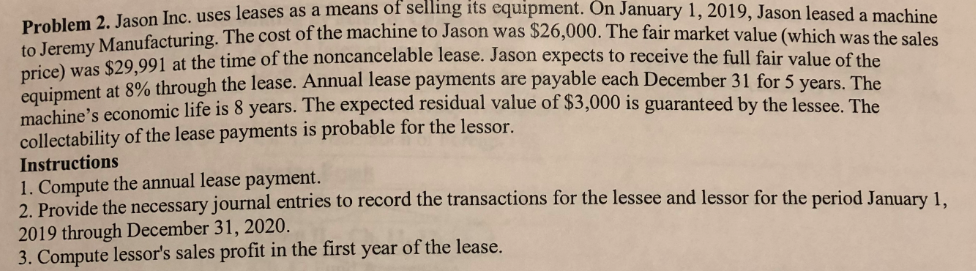

ases as a means of selling its equipment. On January 1, 2019, Jason leased a machine Problem 2. Jason Inc. uses leases as a means of selling it to Jeremy Manufacturing. The cost of the machine to Jason was $26,000. The fair marke e machine to Jason was $26,000. The fair market value (which was the sales price) was $29,991 at the time of the noncancelable la at 80%, through the lease. Annual lease payments are payable each December 31 for 5 years. The equipment at 8% through the lease. Annu machine's economic life is 8 years. The expected residual value of $3,000 is guara ears. The expected residual value of $3,000 is guaranteed by the lessee. The collectability of the lease payments is probable for the lessor. Instructions 1. Compute the annual lease payment. Provide the necessary journal entries to record the transactions for the lessee and lessor for the period January 1. 2019 through December 31, 2020. 3. Compute lessor's sales profit in the first year of the lease. ases as a means of selling its equipment. On January 1, 2019, Jason leased a machine Problem 2. Jason Inc. uses leases as a means of selling it to Jeremy Manufacturing. The cost of the machine to Jason was $26,000. The fair marke e machine to Jason was $26,000. The fair market value (which was the sales price) was $29,991 at the time of the noncancelable la at 80%, through the lease. Annual lease payments are payable each December 31 for 5 years. The equipment at 8% through the lease. Annu machine's economic life is 8 years. The expected residual value of $3,000 is guara ears. The expected residual value of $3,000 is guaranteed by the lessee. The collectability of the lease payments is probable for the lessor. Instructions 1. Compute the annual lease payment. Provide the necessary journal entries to record the transactions for the lessee and lessor for the period January 1. 2019 through December 31, 2020. 3. Compute lessor's sales profit in the first year of the lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts