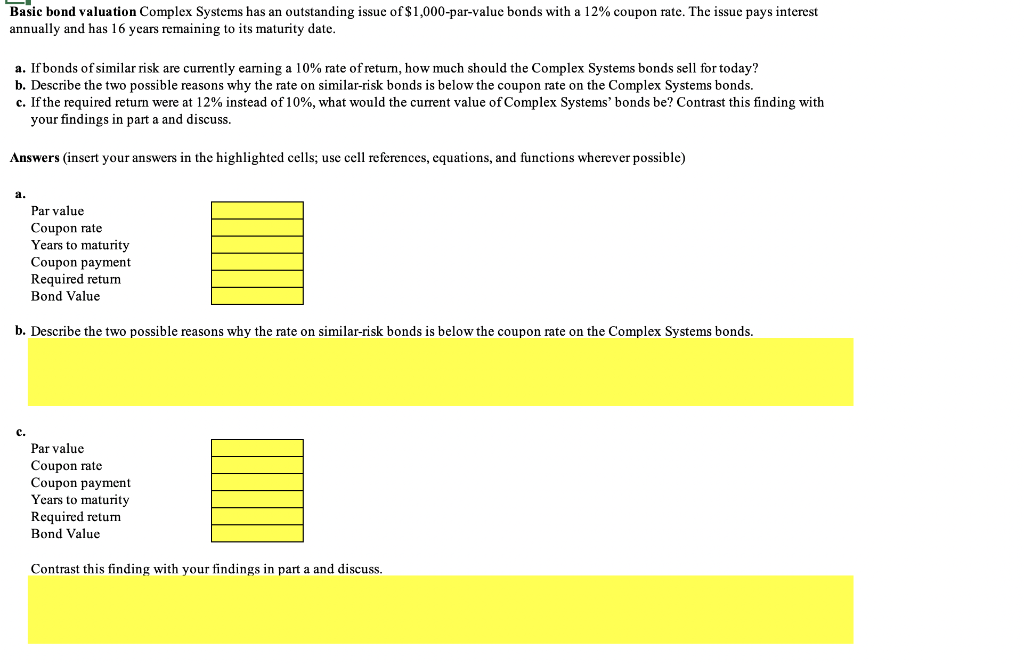

Question: **PLEASE POST THE EQUATIONS I NEED TO TYPE INTO EXCEL AS WELL. A. Per Value: E12 Coupon Rate: E13 Years to maturity: E14 Coupon payment:

**PLEASE POST THE EQUATIONS I NEED TO TYPE INTO EXCEL AS WELL.

A.

Per Value: E12

Coupon Rate: E13

Years to maturity: E14

Coupon payment: E15

Required Return: E16

Bond Value: E17

C.

Par value: E23

Coupon Rate: E24

Coupon payent: E25

Years to maturity: E26

Required return: E27

Bond Value: E28

Basic bond valuation Complex Systems has an outstanding issue of $1,000-par-value bonds with a 12% coupon rate. The issue pays interest annually and has 16 years remaining to its maturity date. a. If bonds of similar risk are currently earning a 10% rate of return, how much should the Complex Systems bonds sell for today? b. Describe the two possible reasons why the rate on similar-risk bonds is below the coupon rate on the Complex Systems bonds. c. If the required return were at 12% instead of 10%, what would the current value of Complex Systems' bonds be? Contrast this finding with your findings in part a and discuss. Answers (insert your answers in the highlighted cells; use cell references, equations, and functions wherever possible) b. Describe the two possible reasons why the rate on similar-risk bonds is below the coupon rate on the Complex Systems bonds. Contrast this finding with your findings in part a and discuss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts