Question: PLEASE POST THE EXCEL FORMULAS !!! THANK YOU !! PLEASE POST THE EXCEL FORMULAS THANK YOU As an investor, you are considering an investment in

PLEASE POST THE EXCEL FORMULAS !!! THANK YOU !!

PLEASE POST THE EXCEL FORMULAS THANK YOU

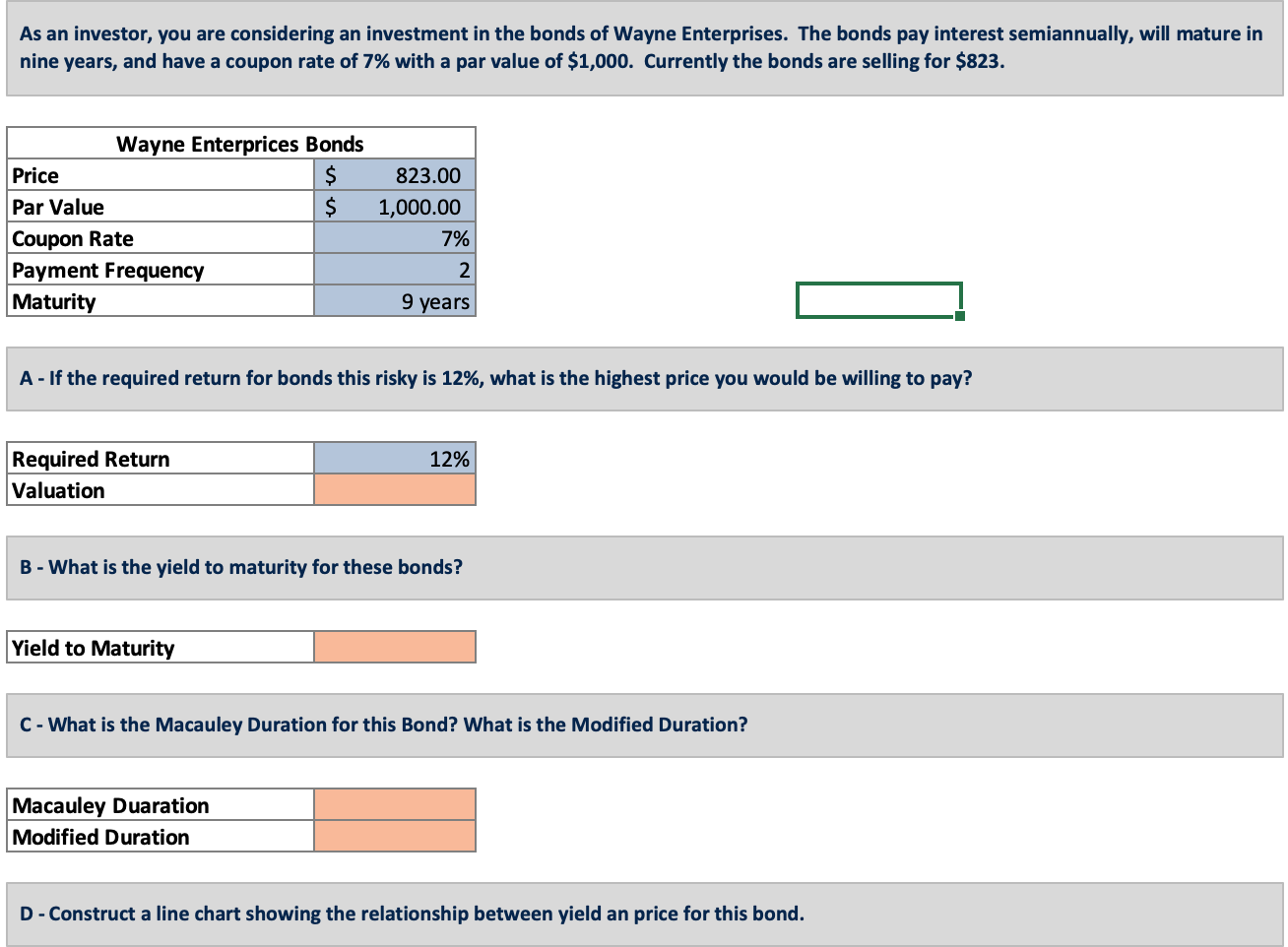

As an investor, you are considering an investment in the bonds of Wayne Enterprises. The bonds pay interest semiannually, will mature in nine years, and have a coupon rate of 7% with a par value of $1,000. Currently the bonds are selling for $823. Wayne Enterprices Bonds Price $ Par Value $ Coupon Rate Payment Frequency Maturity 823.00 1,000.00 7% 2 9 years A - If the required return for bonds this risky is 12%, what is the highest price you would be willing to pay? 12% Required Return Valuation B - What is the yield to maturity for these bonds? Yield to Maturity C- What is the Macauley Duration for this Bond? What is the Modified Duration? Macauley Duaration Modified Duration D - Construct a line chart showing the relationship between yield an price for this bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts