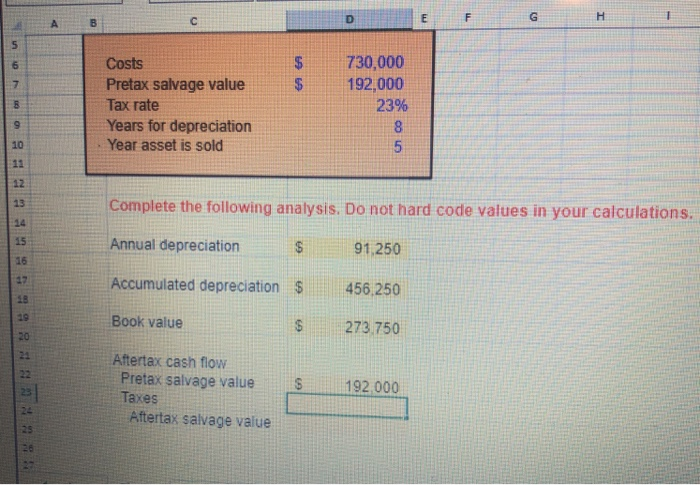

Question: please post your answer as an excel formula 730,000 192,000 Costs Pretax salvage value Tax rate Years for depreciation Year asset is sold 23% Complete

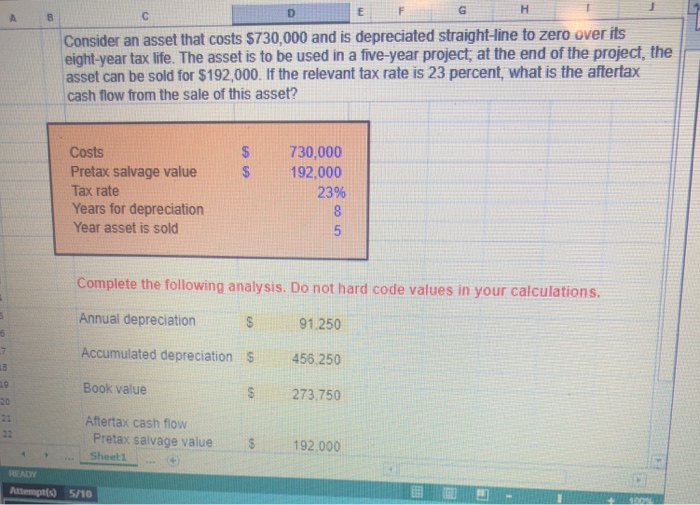

730,000 192,000 Costs Pretax salvage value Tax rate Years for depreciation Year asset is sold 23% Complete the following analysis. Do not hard code values in your calculations. Annual depreciation 91,250 Accumulated depreciation $ 456,250 NGEN BERUBB Book value 273.750 Aftertax cash flow Pretax salvage value Taxes Aftertax salvage value S 192.000 D E F G H Consider an asset that costs $730,000 and is depreciated straight-line to zero over its eight-year tax life. The asset is to be used in a five-year project, at the end of the project, the asset can be sold for $192,000. If the relevant tax rate is 23 percent, what is the aftertax cash flow from the sale of this asset? Costs Pretax salvage value Tax rate Years for depreciation Year asset is sold 730,000 192,000 23% Complete the following analysis. Do not hard code values in your calculations. 91.250 Annual depreciation $ Accumulated depreciation $ 456,250 Book value $ 273,750 Aftertax cash flow Pretax salvage value S 192.000 READY Attempt(s) 5/10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts