Question: please, preferably do each and every point, but anything will be helpful. An investor's position in options on 100,000 units of the underlying has the

please, preferably do each and every point, but anything will be helpful.

please, preferably do each and every point, but anything will be helpful.

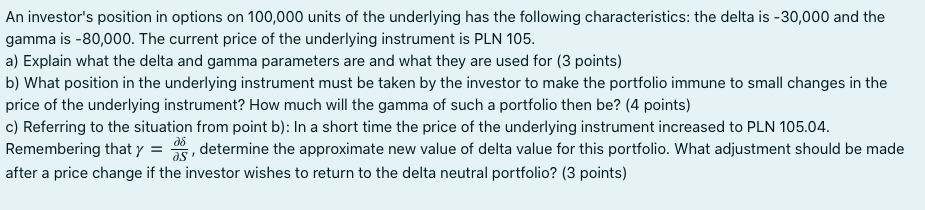

An investor's position in options on 100,000 units of the underlying has the following characteristics: the delta is - 30,000 and the gamma is -80,000. The current price of the underlying instrument is PLN 105. a) Explain what the delta and gamma parameters are and what they are used for (3 points) b) What position in the underlying instrument must be taken by the investor to make the portfolio immune to small changes in the price of the underlying instrument? How much will the gamma of such a portfolio then be? (4 points) c) Referring to the situation from point b): In a short time the price of the underlying instrument increased to PLN 105.04. Remembering that y = as determine the approximate new value of delta value for this portfolio. What adjustment should be made after a price change if the investor wishes to return to the delta neutral portfolio? (3 points) 08

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts