Question: Please prepare a workbook file using the information given below. The file should have three worksheets. The first worksheet must contain only the inputs to

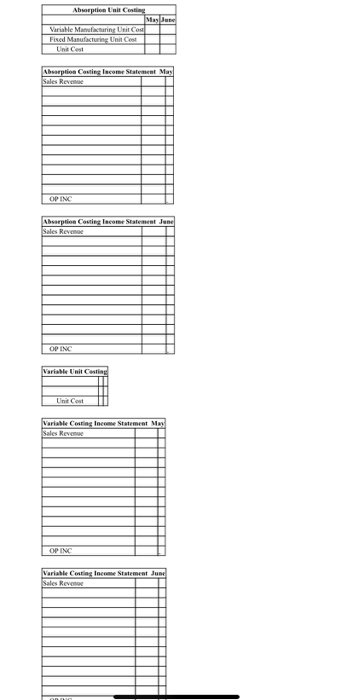

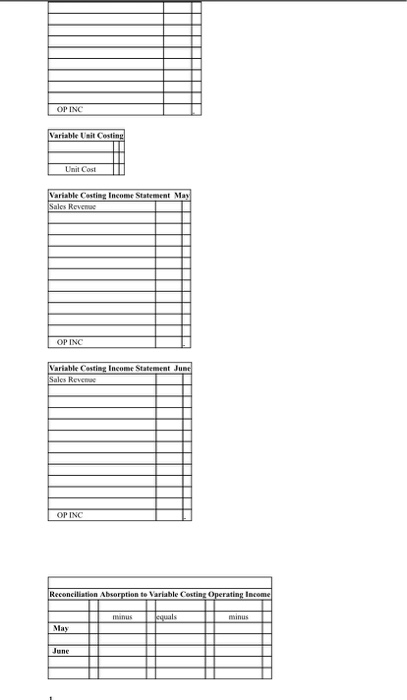

ACCT 317 F20 SS#2 Variable Costing Due Monday 10/05/20 BEFORE CLASS via upload to Moodle Please prepare a workbook file using the information given below. The file should have three worksheets. The first worksheet must contain only the inputs to the problem. These facts will be referenced by the second and third worksheets that contain the transformation of the inputs into the solutions to the problem. The second worksheet must contain: a) unit product cost under absorption costing for May; b) unit product cost under absorption costing for June; c) an income statement in good form for the month of May under absorption costing, d) an income statement in good form for the month of June under absorption costing. The third worksheet must contain: a) unit product cost under variable costing for May, b) unit product cost under variable costing for June; c) an income statement in good form for the month of May under variable costing: d) an income statement in good form for the month of June under variable costing: e) reconciliation of net income under absorption and variable costing for the month of May: 1) reconciliation of net income under absorption and variable costing for the month of June. For requirements e and f. please create a matrix based on the table shown on page 336. Actual Casting FG BB in its Llit production volume May 50 4. 4,000 Variable Cost manufacturing content produced marketing cost penito $400 S400 manufacturing ocal cost 521.120000521.120,000 $5,000,000 $6.000.000 519 $19.00 Cost flow assumption: FIFO Absorption Unit Casting May June Variable Manufacturing Unit C Fixed Manufacturing Unit Cool Unit Cost Absorption Casting Team Statement May Sales Rev Absorption Unit Casting |Mayans Variable Manufacturing Unit Cos Fixed Manufacturing Unit Cest Unit Cost Absorption Cotilacome Statement May Sales Rev OPINO Absorption Coming lacome Start Jone Sales Reve OP INC Variable Unit Casting Unit Cost Variable Costing Inccee Statement May Sales Rev OPIN Variable Costing Income Statement June Sales Rev OP INC Variable Unit Casting Unit Cost Variable Costing Income Statement May Sales Revenge OP INC Variable Casting Income Statement June Sales Revue OP INC Reconciliation Absorption to Variable Costing Operating Income minus May June ACCT 317 F20 SS#2 Variable Costing Due Monday 10/05/20 BEFORE CLASS via upload to Moodle Please prepare a workbook file using the information given below. The file should have three worksheets. The first worksheet must contain only the inputs to the problem. These facts will be referenced by the second and third worksheets that contain the transformation of the inputs into the solutions to the problem. The second worksheet must contain: a) unit product cost under absorption costing for May; b) unit product cost under absorption costing for June; c) an income statement in good form for the month of May under absorption costing, d) an income statement in good form for the month of June under absorption costing. The third worksheet must contain: a) unit product cost under variable costing for May, b) unit product cost under variable costing for June; c) an income statement in good form for the month of May under variable costing: d) an income statement in good form for the month of June under variable costing: e) reconciliation of net income under absorption and variable costing for the month of May: 1) reconciliation of net income under absorption and variable costing for the month of June. For requirements e and f. please create a matrix based on the table shown on page 336. Actual Casting FG BB in its Llit production volume May 50 4. 4,000 Variable Cost manufacturing content produced marketing cost penito $400 S400 manufacturing ocal cost 521.120000521.120,000 $5,000,000 $6.000.000 519 $19.00 Cost flow assumption: FIFO Absorption Unit Casting May June Variable Manufacturing Unit C Fixed Manufacturing Unit Cool Unit Cost Absorption Casting Team Statement May Sales Rev Absorption Unit Casting |Mayans Variable Manufacturing Unit Cos Fixed Manufacturing Unit Cest Unit Cost Absorption Cotilacome Statement May Sales Rev OPINO Absorption Coming lacome Start Jone Sales Reve OP INC Variable Unit Casting Unit Cost Variable Costing Inccee Statement May Sales Rev OPIN Variable Costing Income Statement June Sales Rev OP INC Variable Unit Casting Unit Cost Variable Costing Income Statement May Sales Revenge OP INC Variable Casting Income Statement June Sales Revue OP INC Reconciliation Absorption to Variable Costing Operating Income minus May June

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts