Question: Please present the answer neatly. Thanks Question #3. (25 points) The Ajax Corporation has an overhead crane that has an estimated remaining life of 10

Please present the answer neatly. Thanks

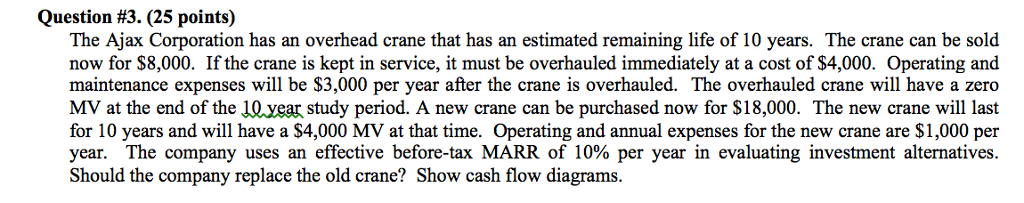

Question #3. (25 points) The Ajax Corporation has an overhead crane that has an estimated remaining life of 10 years. The crane can be sold now for $8,000. If the crane is kept in service, it must be overhauled immediately at a cost of $4,000. Operating and maintenance expenses will be $3,000 per year after the crane is overhauled. The overhauled crane will have a zero MV at the end of the 1Qyear study period. A new crane can be purchased now for $18,000. The new crane will last for 10 years and will have a S4,000 MV at that time. Operating and annual expenses for the new crane are $1,000 per year. The company uses an effective before-tax MARR of 10% per year in evaluating investment alternatives. Should the company replace the old crane? Show cash flow diagrams

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts