Question: please present with computations 1 Problem 3 (Small and Large Stock Dividends) On November 7, Lauren Enterprise Company declared a share capital dividend distributable to

please present with computations

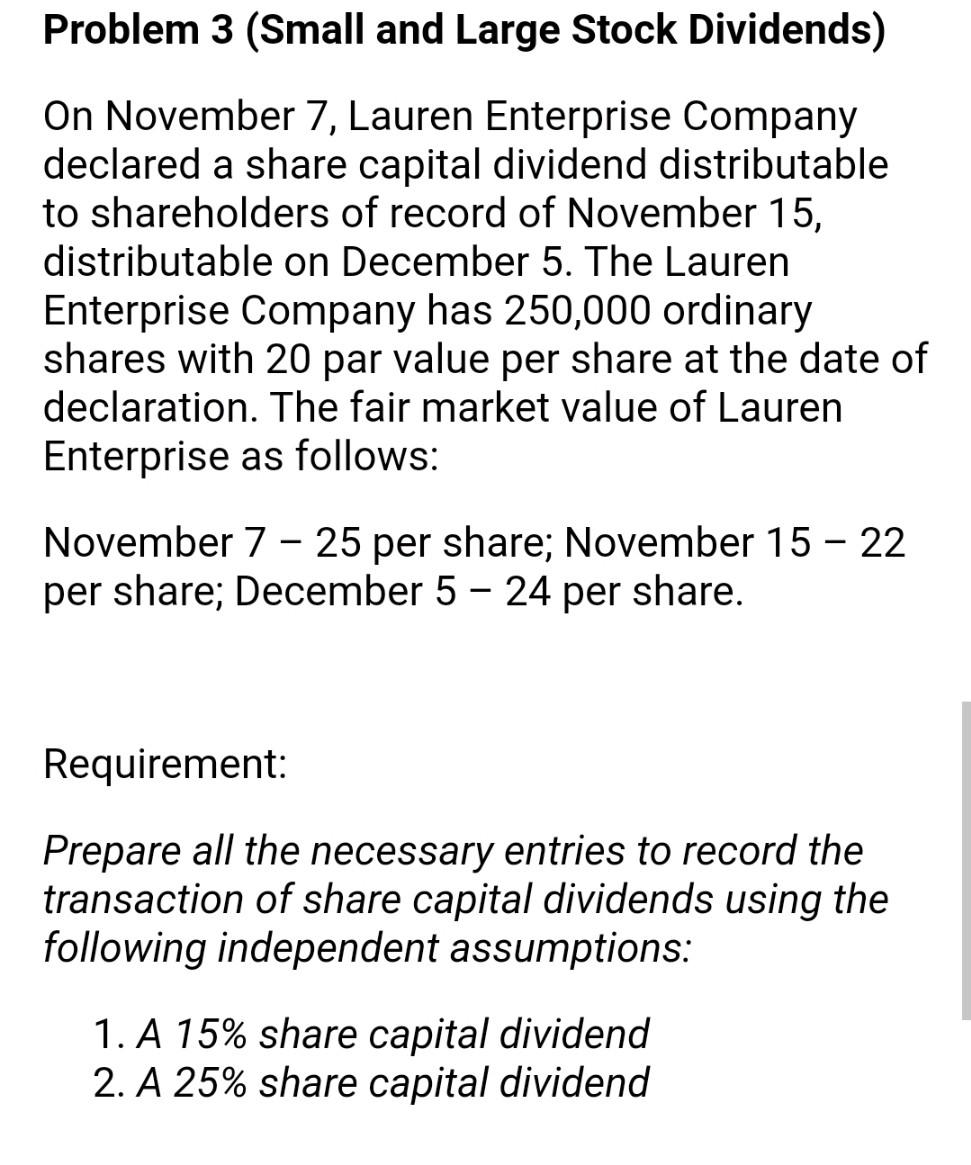

1 Problem 3 (Small and Large Stock Dividends) On November 7, Lauren Enterprise Company declared a share capital dividend distributable to shareholders of record of November 15, distributable on December 5. The Lauren Enterprise Company has 250,000 ordinary shares with 20 par value per share at the date of declaration. The fair market value of Lauren Enterprise as follows: November 7 - 25 per share; November 15 - 22 per share; December 5 - 24 per share. Requirement: Prepare all the necessary entries to record the transaction of share capital dividends using the following independent assumptions: 1. A 15% share capital dividend 2. A 25% share capital dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts