Question: Please provide a solution for all 5 parts. 5. A professional football player has a three-year contract on hand at the beginning of the 2020

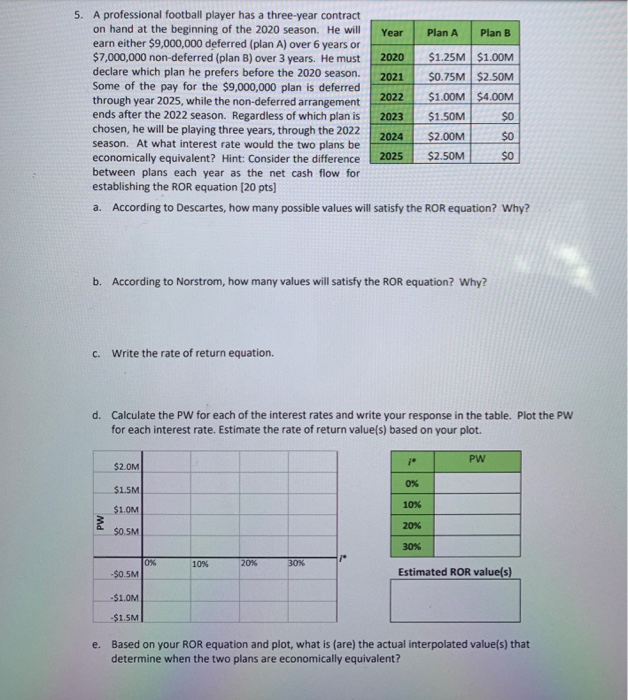

5. A professional football player has a three-year contract on hand at the beginning of the 2020 season. He will Year Plan A Plan B earn either $9,000,000 deferred (plan A) over 6 years or $7,000,000 non-deferred (plan B) over 3 years. He must $1.25M $1.00M declare which plan he prefers before the 2020 season. 2021 $0.75M $2.50M Some of the pay for the $9,000,000 plan is deferred 2022 through year 2025, while the non-deferred arrangement $1.00M $4.00M ends after the 2022 season. Regardless of which plan is 2023 $1.50M $0 chosen, he will be playing three years, through the 2022 2024 $2.00M $0 season. At what interest rate would the two plans be economically equivalent? Hint: Consider the difference 2025 $2.50M $0 between plans each year as the net cash flow for establishing the ROR equation (20 pts) a. According to Descartes, how many possible values will satisfy the ROR equation? Why? b. According to Norstrom, how many values will satisfy the ROR equation? Why? C. Write the rate of return equation. d. Calculate the PW for each of the interest rates and write your response in the table. Plot the PW for each interest rate. Estimate the rate of return value(s) based on your plot. PW $2.OM 0% $1.5M 10% $1.0M 2 SSV 20% 30% 10% -$0.5M Estimated ROR value(s) -$1.0M -$1.5M| e. Based on your ROR equation and plot, what is (are) the actual interpolated value(s) that determine when the two plans are economically equivalent? 5. A professional football player has a three-year contract on hand at the beginning of the 2020 season. He will Year Plan A Plan B earn either $9,000,000 deferred (plan A) over 6 years or $7,000,000 non-deferred (plan B) over 3 years. He must $1.25M $1.00M declare which plan he prefers before the 2020 season. 2021 $0.75M $2.50M Some of the pay for the $9,000,000 plan is deferred 2022 through year 2025, while the non-deferred arrangement $1.00M $4.00M ends after the 2022 season. Regardless of which plan is 2023 $1.50M $0 chosen, he will be playing three years, through the 2022 2024 $2.00M $0 season. At what interest rate would the two plans be economically equivalent? Hint: Consider the difference 2025 $2.50M $0 between plans each year as the net cash flow for establishing the ROR equation (20 pts) a. According to Descartes, how many possible values will satisfy the ROR equation? Why? b. According to Norstrom, how many values will satisfy the ROR equation? Why? C. Write the rate of return equation. d. Calculate the PW for each of the interest rates and write your response in the table. Plot the PW for each interest rate. Estimate the rate of return value(s) based on your plot. PW $2.OM 0% $1.5M 10% $1.0M 2 SSV 20% 30% 10% -$0.5M Estimated ROR value(s) -$1.0M -$1.5M| e. Based on your ROR equation and plot, what is (are) the actual interpolated value(s) that determine when the two plans are economically equivalent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts