Question: Please provide a step-by-step analysis and use formulas or ways to arrive at your answer via Excel if possible. Thank you. MACRS Schedule is below:

Please provide a step-by-step analysis and use formulas or ways to arrive at your answer via Excel if possible. Thank you.

MACRS Schedule is below:

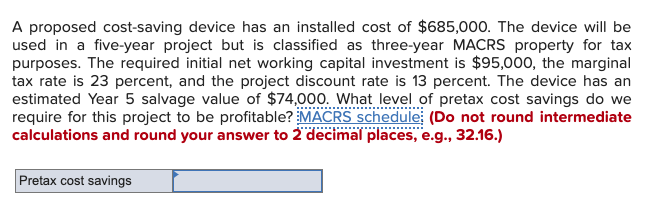

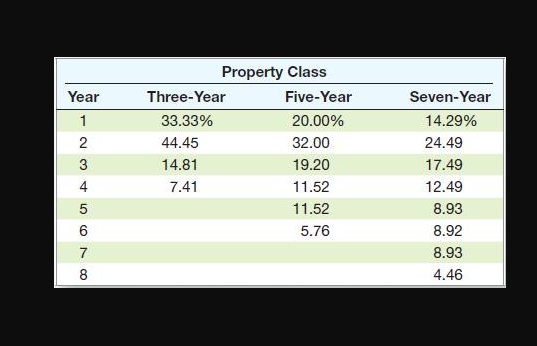

A proposed cost-saving device has an installed cost of $685,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes. The required initial net working capital investment is $95,000, the marginal tax rate is 23 percent, and the project discount rate is 13 percent. The device has an estimated Year 5 salvage value of $74,000. What level of pretax cost savings do we require for this project to be profitable? MACRS Schedule; (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Pretax cost savings Property Class Year Three-Year Five-Year Seven-Year 1 33.33% 20.00% 14.29% 2 44.45 32.00 24.49 14.81 3 19.20 17.49 11.52 4 7.41 12.49 11.52 5 8.93 6 5.76 8.92 8.93 4.46 LO CO N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts