Question: please provide a well detailed explanation. pls avoid using the answers already available in Chegg to answer my question as some tutors have given me

please provide a well detailed explanation. pls avoid using the answers already available in Chegg to answer my question as some tutors have given me that same particular answer.

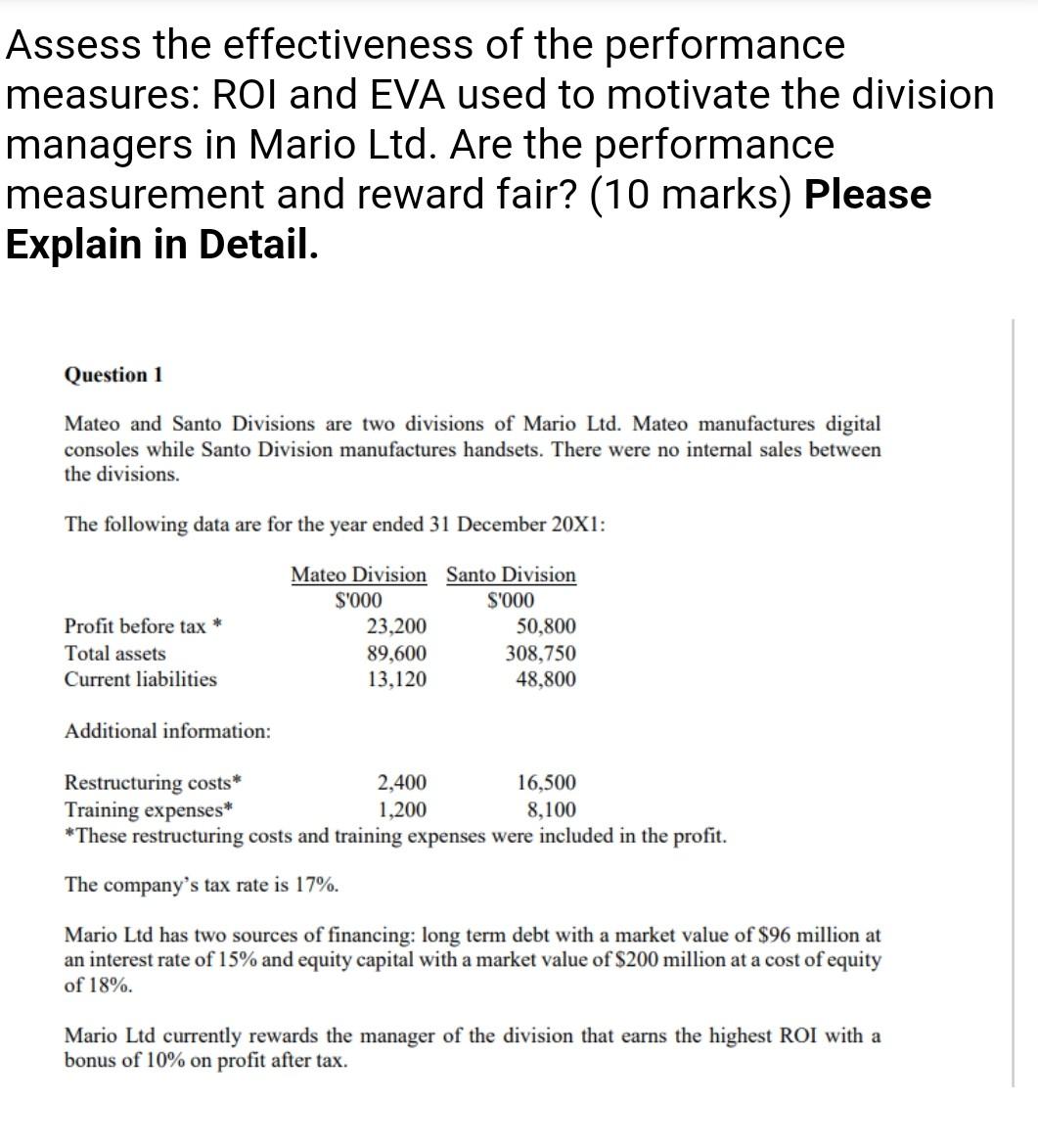

Assess the effectiveness of the performance measures: ROI and EVA used to motivate the division managers in Mario Ltd. Are the performance measurement and reward fair? (10 marks) Please Explain in Detail. Question 1 Mateo and Santo Divisions are two divisions of Mario Ltd. Mateo manufactures digital consoles while Santo Division manufactures handsets. There were no internal sales between the divisions. The following data are for the year ended 31 December 20X1 : Additional information: *These restructuring costs and training expenses were included in the profit. The company's tax rate is 17%. Mario Ltd has two sources of financing: long term debt with a market value of $96 million at an interest rate of 15% and equity capital with a market value of $200 million at a cost of equity of 18%. Mario Ltd currently rewards the manager of the division that earns the highest ROI with a bonus of 10% on profit after tax. Assess the effectiveness of the performance measures: ROI and EVA used to motivate the division managers in Mario Ltd. Are the performance measurement and reward fair? (10 marks) Please Explain in Detail. Question 1 Mateo and Santo Divisions are two divisions of Mario Ltd. Mateo manufactures digital consoles while Santo Division manufactures handsets. There were no internal sales between the divisions. The following data are for the year ended 31 December 20X1 : Additional information: *These restructuring costs and training expenses were included in the profit. The company's tax rate is 17%. Mario Ltd has two sources of financing: long term debt with a market value of $96 million at an interest rate of 15% and equity capital with a market value of $200 million at a cost of equity of 18%. Mario Ltd currently rewards the manager of the division that earns the highest ROI with a bonus of 10% on profit after tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts