Question: please provide accurate calculation( do not use any Ai software to solve) Jorge Garcia Ine. has declared a $13.75 per-share dividend. Suppose capital gains are

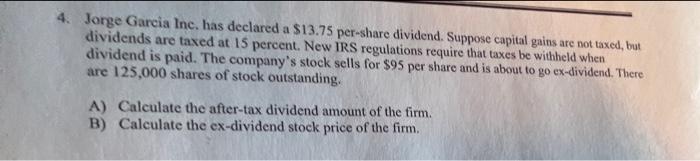

Jorge Garcia Ine. has declared a $13.75 per-share dividend. Suppose capital gains are not taxed, but dividends are taxed at 15 percent. New IRS regulations require that taxes be withheld when dividend is paid. The company's stock sells for $95 per share and is about to go ex-dividend. There are 125,000 shares of stock outstanding. A) Calculate the after-tax dividend amount of the firm. B) Calculate the ex-dividend stock price of the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts