Question: please provide accurate calculation( do not use any Ai software to solve) 2. Albieri & Kevin Investment Firm is an unlevered corporation which has $250

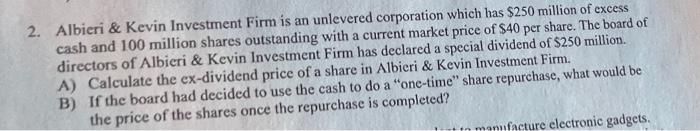

2. Albieri \& Kevin Investment Firm is an unlevered corporation which has $250 million of excess cash and 100 million shares outstanding with a current market price of $40 per share. The board of directors of Albieri \& Kevin Investment Firm has declared a special dividend of $250 million. A) Calculate the ex-dividend price of a share in Albieri \& Kevin Investment Firm. B) If the board had decided to use the cash to do a "one-time" share repurchase, what would be the price of the shares once the repurchase is completed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts