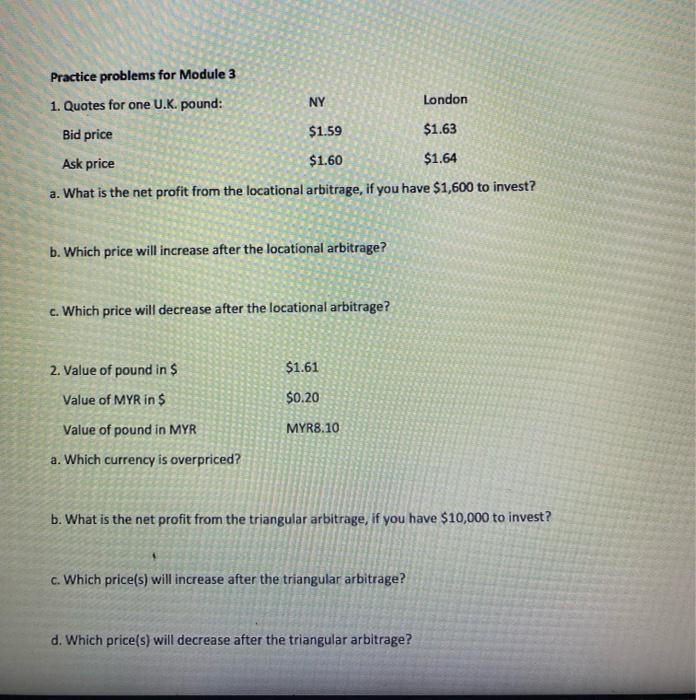

Question: please provide all answers with calculations !! Practice problems for Module 3 1. Quotes for one U.K. pound: NY London Bid price $1.59 $1.63 Ask

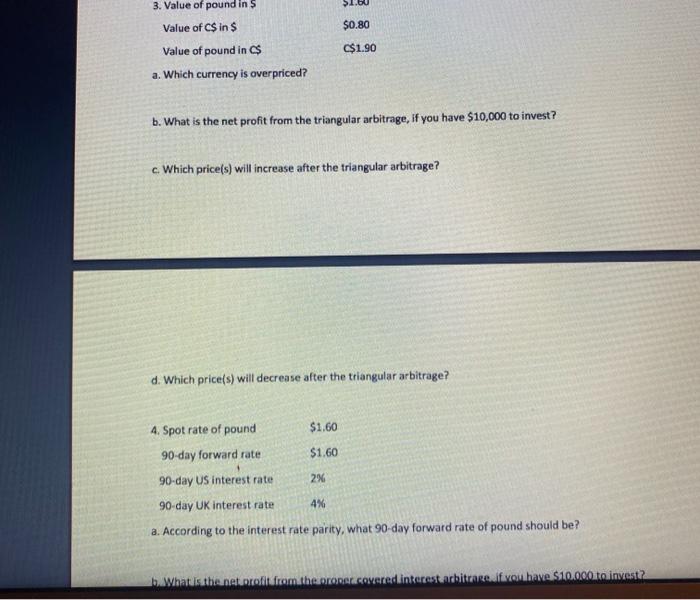

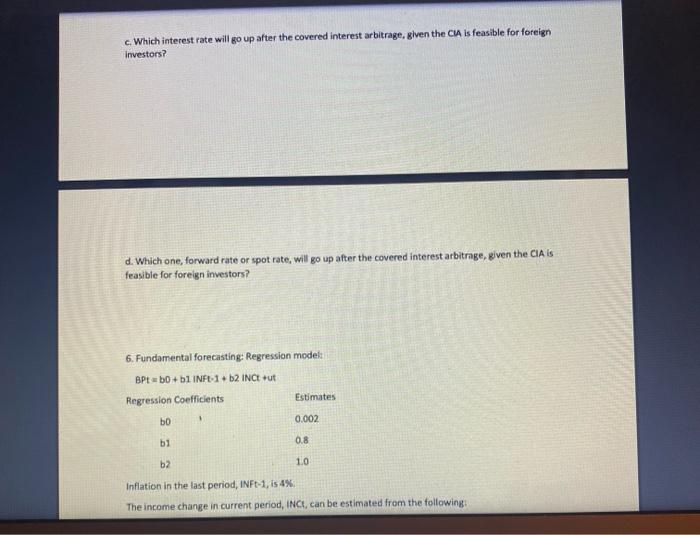

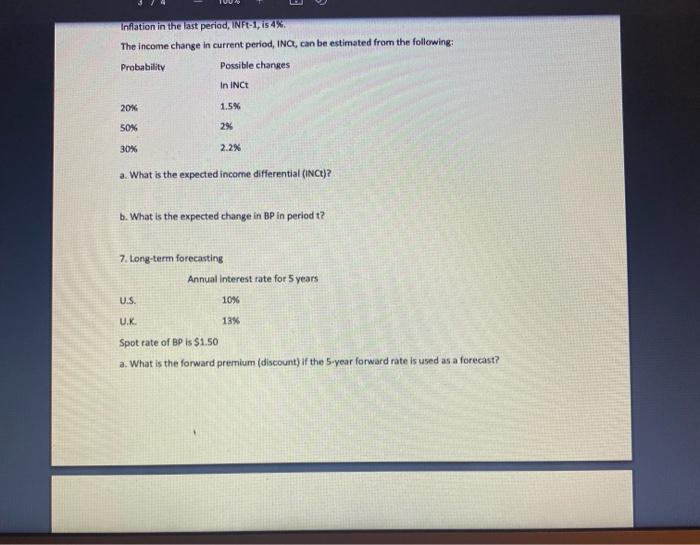

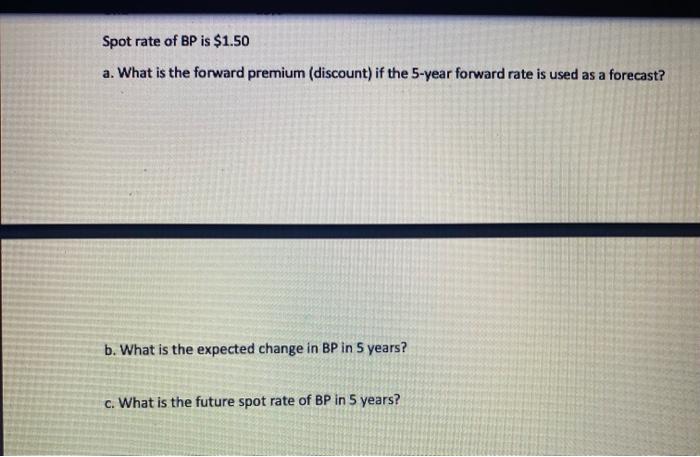

Practice problems for Module 3 1. Quotes for one U.K. pound: NY London Bid price $1.59 $1.63 Ask price $1.60 $1.64 a. What is the net profit from the locational arbitrage, if you have $1,600 to invest? b. Which price will increase after the locational arbitrage? c. Which price will decrease after the locational arbitrage? $1.61 2. Value of pound in $ Value of MYR in $ $0.20 Value of pound in MYR MYR8.10 a. Which currency is overpriced? b. What is the net profit from the triangular arbitrage, if you have $10,000 to invest? c. Which price(s) will increase after the triangular arbitrage? d. Which price(s) will decrease after the triangular arbitrage? 1.60 $0.80 3. Value of pound in 5 Value of C$ in $ Value of pound in a. Which currency is overpriced? $1.90 b. What is the net profit from the triangular arbitrage, if you have $10,000 to invest? c. Which price(s) will increase after the triangular arbitrage? d. Which price(s) will decrease after the triangular arbitrage? 4. Spot rate of pound $1.60 90-day forward rate $1.60 90-day US interest rate 2% 90-day UK interest rate 4% a. According to the interest rate parity, what 90-day forward rate of pound should be? b. What is the netrofit from the RACCONered interest achitrakoot have $10,000 to invest? c. Which interest rate will go up after the covered interest arbitrage, given the CIA is feasible for foreign Investors? d. Which one, forward rate or spot rate, will go up after the covered interest arbitrage, given the CIA is feasible for foreign investors? 6. Fundamental forecasting: Regression model BPt-bD+51 INFL-1.2 INC ut Regression Coefficients Estimates bo 0.002 b1 0.8 b2 1.0 Inflation in the last period, INF:-1, is 4% The income change in current period, INCI, can be estimated from the following: Inflation in the last period, INF-1, 154% The Income change in current period, INCI, can be estimated from the following: Probability Possible changes In INCI 20% 1.5% 50% 2% 30% 2.2% a. What is the expected income differential (INCI)? b. What is the expected change in BP in period t? 7. Long-term forecasting Annual Interest rate for 5 years US 10% UK 13% Spot rate of BP is $1.50 a. What is the forward premium (discount) if the 5-year forward rate is used as a forecast? Spot rate of BP is $1.50 a. What is the forward premium (discount) if the 5-year forward rate is used as a forecast? b. What is the expected change in BP in 5 years? c. What is the future spot rate of BP in 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts