Question: please provide an answer to every box outlined in blue. boxes not outlined do not require an answer. also please provide answers in table format

please provide an answer to every box outlined in blue. boxes not outlined do not require an answer. also please provide answers in table format as shown by the picture

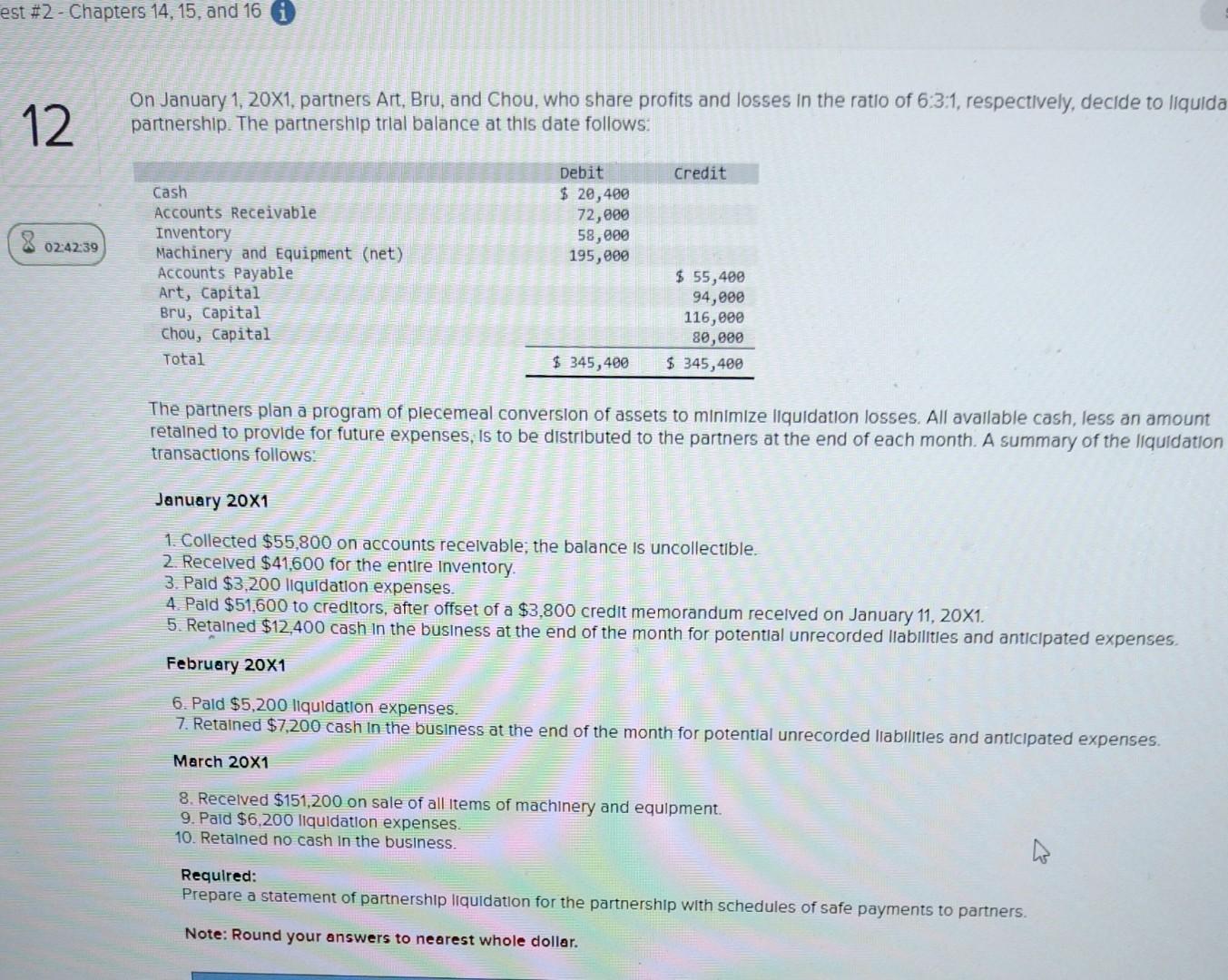

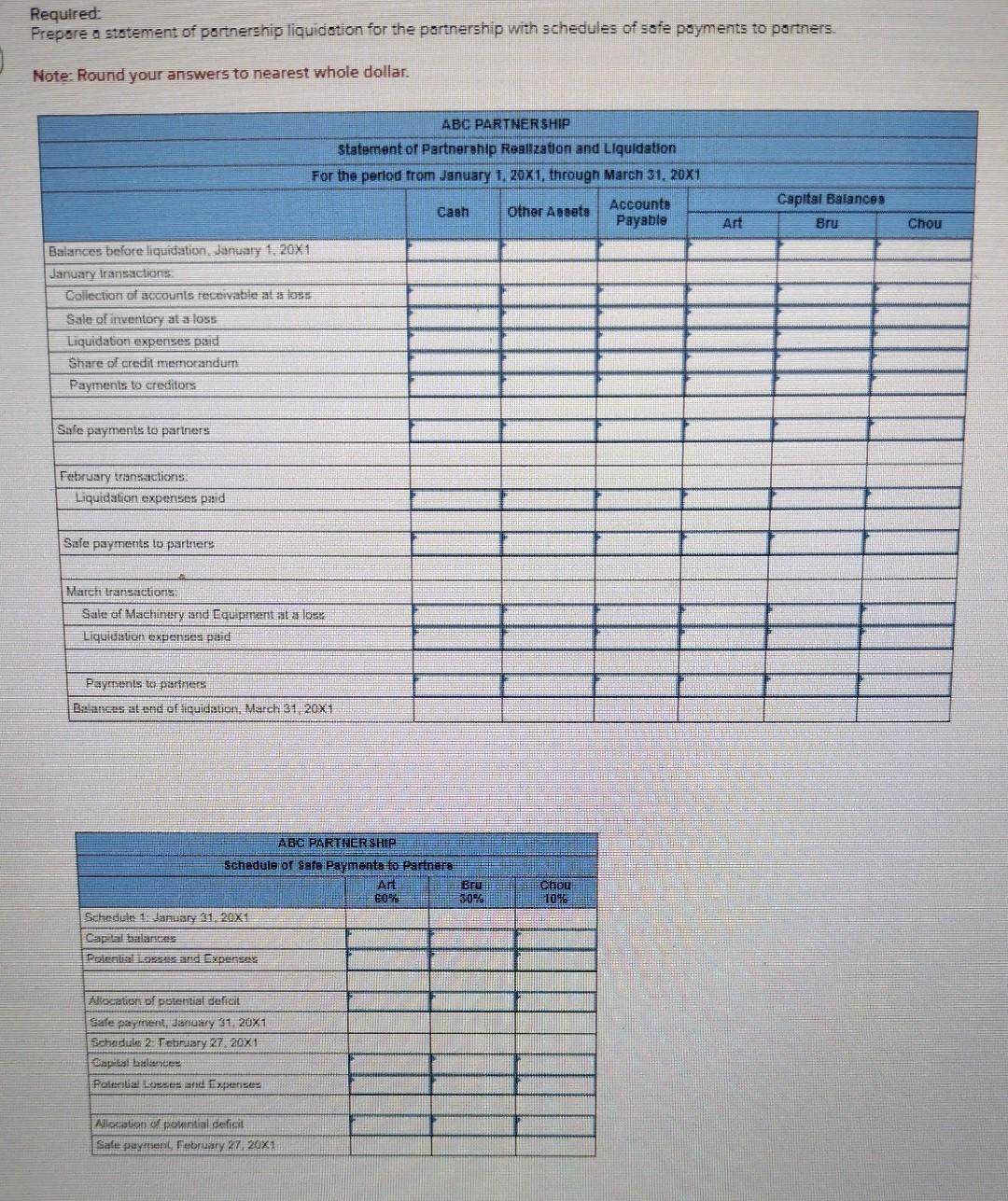

On January 1, 20X1, partners Art, Bru, and Chou, who share profits and losses in the ratio of 6:3:1, respectively, decide to liquide partnership. The partnership trlal balance at this date follows: The partners plan a program of plecemeal conversion of assets to minimize liquidation losses. All available cash, less an amount retalned to provide for future expenses, Is to be distributed to the partners at the end of each month. A summary of the liquidation transactions follows: January 201 1. Collected $55,800 on accounts receivable; the balance is uncollectible. 2. Recelved $41,600 for the entire Inventory. 3. Pald $3,200 liquidation expenses. 4. Pald $51,600 to creditors, after offset of a $3,800 credit memorandum recelved on January 11,201. 5. Retained $12,400 cash in the business at the end of the month for potential unrecorded llabilities and anticipated expenses. February 201 6. Pald $5,200 liquidation expenses. 7. Retained $7,200 cash in the business at the end of the month for potential unrecorded Ilabilities and anticipated expenses. March 20x1 8. Recelved $151,200 on sale of all items of machinery and equipment. 9. Paid $6,200 liquidation expenses. 10. Retained no cash in the business. Required: Prepare a statement of partnership liquldation for the partnership with schedules of safe payments to partners. Note: Round your answers to nearest whole dollar. Required: Prepore a ststement of portnership liquidotion for the portnership with schedules of sofe poyments to porthers. Note: Round your answers to nearest whole dollar. On January 1, 20X1, partners Art, Bru, and Chou, who share profits and losses in the ratio of 6:3:1, respectively, decide to liquide partnership. The partnership trlal balance at this date follows: The partners plan a program of plecemeal conversion of assets to minimize liquidation losses. All available cash, less an amount retalned to provide for future expenses, Is to be distributed to the partners at the end of each month. A summary of the liquidation transactions follows: January 201 1. Collected $55,800 on accounts receivable; the balance is uncollectible. 2. Recelved $41,600 for the entire Inventory. 3. Pald $3,200 liquidation expenses. 4. Pald $51,600 to creditors, after offset of a $3,800 credit memorandum recelved on January 11,201. 5. Retained $12,400 cash in the business at the end of the month for potential unrecorded llabilities and anticipated expenses. February 201 6. Pald $5,200 liquidation expenses. 7. Retained $7,200 cash in the business at the end of the month for potential unrecorded Ilabilities and anticipated expenses. March 20x1 8. Recelved $151,200 on sale of all items of machinery and equipment. 9. Paid $6,200 liquidation expenses. 10. Retained no cash in the business. Required: Prepare a statement of partnership liquldation for the partnership with schedules of safe payments to partners. Note: Round your answers to nearest whole dollar. Required: Prepore a ststement of portnership liquidotion for the portnership with schedules of sofe poyments to porthers. Note: Round your answers to nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts