Question: Please provide answer for B You can download the image and zoom 608 325 250 Question 1 The table below contains information collected from Bloomberg

Please provide answer for B You can download the image and zoom

You can download the image and zoom

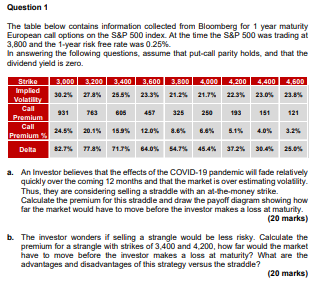

608 325 250 Question 1 The table below contains information collected from Bloomberg for 1 year maturity European call options on the S&P 500 index. At the time the S&P 500 was trading at 3,800 and the 1-year risk free rate was 0.25% In answering the following questions, assume that put-call parity holds, and that the dividend yield is zero. Strike 3.000 3.200 3.400 3,600 3.800 4.000 4.200 4,400 4,600 Implied 30.2 27.8% 25.5% 23.3% 21.25 21.7% 22.3% 23.0% 23.8% Volatility Call 931 763 457 193 181 121 Premium Call 5.1% 24.5% 20.1% 15.9% 12.0% 8.8% 8.8% Premium 4.0% Delta 12.7% 77.8% 71.7% 84.0% 54.7% 45.4% 37.2% 30.4% 25.0% a. An Investor believes that the effects of the COVID-19 pandemic will fade relatively quickly over the coming 12 months and that the market is over estimating volatility Thus, they are considering selling a straddle with an at-the-money strike. Calculate the premium for this straddle and draw the payoff diagram showing how far the market would have to move before the investor makes a loss at maturity () (20 marks) b. The investor wonders if selling a strangle would be less risky. Calculate the premium for a strangle with strikes of 3.400 and 4,200, how far would the market have to move before the investor makes a loss at maturity? What are the advantages and disadvantages of this strategy versus the straddle? (20 marks) 608 325 250 Question 1 The table below contains information collected from Bloomberg for 1 year maturity European call options on the S&P 500 index. At the time the S&P 500 was trading at 3,800 and the 1-year risk free rate was 0.25% In answering the following questions, assume that put-call parity holds, and that the dividend yield is zero. Strike 3.000 3.200 3.400 3,600 3.800 4.000 4.200 4,400 4,600 Implied 30.2 27.8% 25.5% 23.3% 21.25 21.7% 22.3% 23.0% 23.8% Volatility Call 931 763 457 193 181 121 Premium Call 5.1% 24.5% 20.1% 15.9% 12.0% 8.8% 8.8% Premium 4.0% Delta 12.7% 77.8% 71.7% 84.0% 54.7% 45.4% 37.2% 30.4% 25.0% a. An Investor believes that the effects of the COVID-19 pandemic will fade relatively quickly over the coming 12 months and that the market is over estimating volatility Thus, they are considering selling a straddle with an at-the-money strike. Calculate the premium for this straddle and draw the payoff diagram showing how far the market would have to move before the investor makes a loss at maturity () (20 marks) b. The investor wonders if selling a strangle would be less risky. Calculate the premium for a strangle with strikes of 3.400 and 4,200, how far would the market have to move before the investor makes a loss at maturity? What are the advantages and disadvantages of this strategy versus the straddle? (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts