Question: Please answer part C Question 1 The table below contains information collected from Bloomberg for 1 year maturity European call options on the S&P 500

Please answer part C

Please answer part C

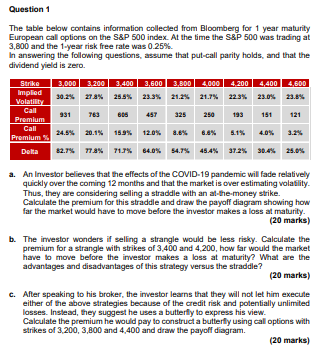

Question 1 The table below contains information collected from Bloomberg for 1 year maturity European call options on the S&P 500 index. At the time the S&P 500 was trading at 3,800 and the 1-year risk free rate was 0.25% In answering the following questions, assume that put-call parity holds, and that the dividend yield is zero. Strike 3.000 3.200 3.400 3,600 3.800 4.000 4.200 4.400 4,600 Implied 30.2% 27.8% 25.5% 23.3% 21.25 21.7% 22.3% 23.0% 23.8% Volatility 931 763 808 457 325 250 193 121 Premium Call 24.5% 20.1% 15.9% 120% 8.8% 6.6% % Premium 5.1% 4.0% 3.25 Delta 82.7% 77.8% 71.1% 84.0% 54.7% 45.4% 37.2% 30.4% 25.0% Call a. An Investor believes that the effects of the COVID-19 pandemic will fade relatively quickly over the coming 12 months and that the market is over estimating volatility Thus, they are considering selling a straddle with an at-the-money strike. Calculate the premium for this straddle and draw the payoff diagram showing how far the market would have to move before the investor makes a loss at maturity. (20 marks) b. The investor wonders if selling a strangle would be less risky. Calculate the premium for a strangle with strikes of 3.400 and 4.200, how far would the market have to move before the investor makes a loss at maturity? What are the advantages and disadvantages of this strategy versus the straddle? (20 marks) c. After speaking to his broker, the investor learns that they will not let him execute either of the above strategies because of the credit risk and potentially unlimited losses. Instead, they suggest he uses a butterfly to express his view. Calculate the premium he would pay to construct a butterfly using call options with strikes of 3.200, 3,800 and 4,400 and draw the payoff diagram. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts