Question: Please provide answer to the problems below. Question 6 (20 points) Answer the following two independent questions. a. [10 points] MM Corporation is considering several

Please provide answer to the problems below.

![the following two independent questions. a. [10 points] MM Corporation is considering](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/67397a02b0590_03467397a0279472.jpg)

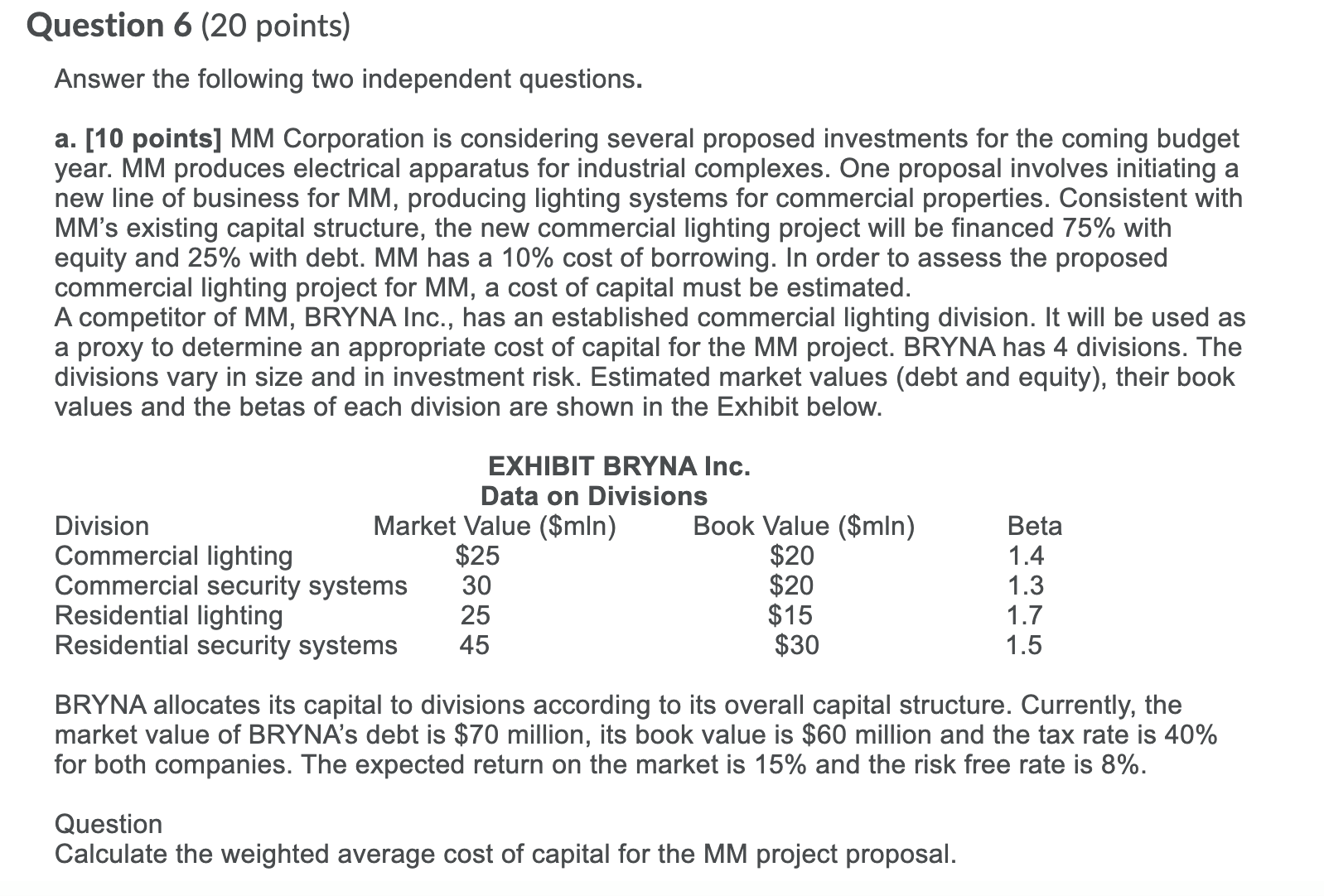

Question 6 (20 points) Answer the following two independent questions. a. [10 points] MM Corporation is considering several proposed investments for the coming budget year. MM produces electrical apparatus for industrial complexes. One proposal involves initiating a new line of business for MM, producing lighting systems for commercial properties. Consistent with MM's existing capital structure, the new commercial lighting project will be financed 75% with equity and 25% with debt. MM has a 10% cost of borrowing. In order to assess the proposed commercial lighting project for MM. a cost of capital must be estimated. A competitor of MM, BRYNA Inc., has an established commercial lighting division. It will be used as a proxy to determine an appropriate cost of capital for the MM project. BRYNA has 4 divisions. The divisions vary in size and in investment risk. Estimated market values (debt and equity), their book values and the betas of each division are shown in the Exhibit below. EXHIBIT BRYNA Inc. Data on Divisions Division Market Value ($mln) Book Value ($mln) Beta Commercial lighting $25 $20 1.4 Commercial security systems 30 $20 1.3 Residential lighting 25 $15 1.7 Residential security systems 45 $30 1.5 BRYNA allocates its capital to divisions according to its overall capital structure. Currently, the market value of BRYNA's debt is $70 million, its book value is $60 million and the tax rate is 40% for both companies. The expected return on the market is 15% and the risk free rate is 8%. Question Calculate the weighted average cost of capital for the MM project proposal. b. [10 points] Quebec Inc, a retail rm, is making a decision on how much it should pay out to its stockholders. It has $100 million in investible funds. The following information is provided about the firm: - It has 100 million shares outstanding, each share selling for $15. The beta of the stock is 1.25 and the risk- free rate is 8%. The expected return on the market is 16%. - The firm has $ 500 million of debt outstanding. The marginal interest rate on the debt is 12%. - The corporation's tax rate is 50%. - The firm has the following investment projects: Project Investment IRR Requirement A 15 million 27% B 10 million 20% C 30 million 12% The rm plans to finance all its investment needs at its current debt ratio and the risk of the projects is similar to the rm. Question Should the company return money to its stockholders? If so, how much should be returned to stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts