Question: please provide calculation steps 19. Assume that the balance sheet and income statement of a French subsidiary, which keeps its books in euro, is translated

please provide calculation steps

please provide calculation steps

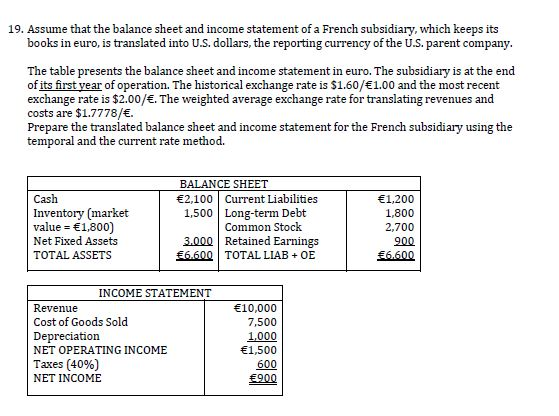

19. Assume that the balance sheet and income statement of a French subsidiary, which keeps its books in euro, is translated into U.S. dollars, the reporting currency of the U.S.parent company The table presents the balance sheet and income statement in euro. The subsidiary is at the end of its first year of operation. The historical exchange rate is $1.60/1.00 and the most recent exchange rate is $2.00/. The weighted average exchange rate for translating revenues and costs are $1.7778/. Prepare the translated balance sheet and income statement for the French subsidiary using the temporal and the current rate method. Cash Inventory (market value = 1,800) Net Fixed Assets TOTAL ASSETS BALANCE SHEET 2,100 Current Liabilities 1,500 Long-term Debt Common Stock 3.000 Retained Earnings 6.600 TOTAL LIAB+ OE 1,200 1,800 2,700 900 $6.600 INCOME STATEMENT Revenue Cost of Goods Sold Depreciation NET OPERATING INCOME Taxes (40%) NET INCOME 10,000 7,500 1.000 1,500 600 900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts