Question: please provide clear step by step answers. Question 5 (20 Marks) Blue Wail appointed you as their finarice manager. The compary is considering inveating in

please provide clear step by step answers.

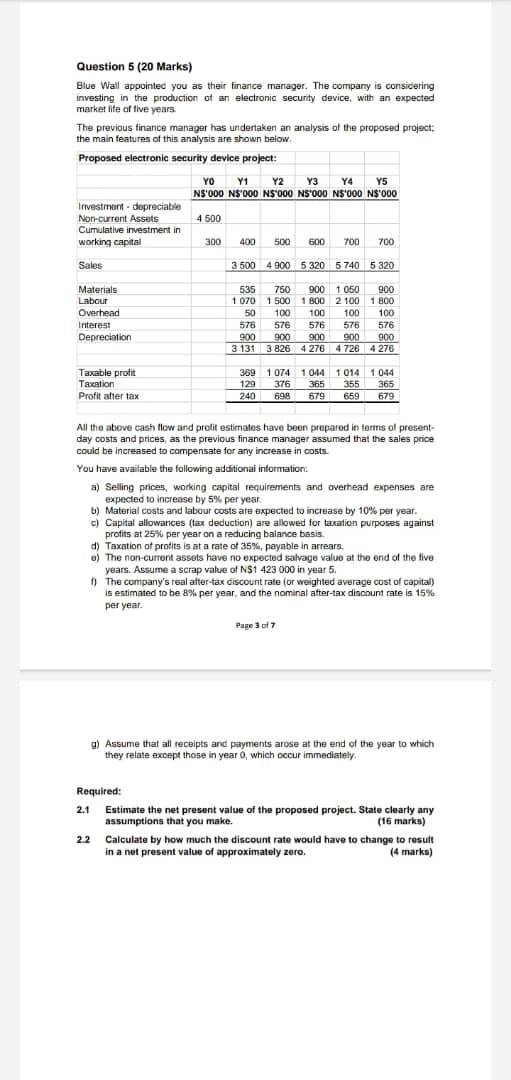

Question 5 (20 Marks) Blue Wail appointed you as their finarice manager. The compary is considering inveating in the production of an electronic secunty device, with an expected market lite of tive years. The previous finance manager has undertaken an analysis of the proposed project: the main features of this analysis are shown below. All the abeve cash flow and prefit estimates have been prepared in terms of presentday costs and prices, as the previous finance manager assumed that the sales price could be increased to compensate for any increase in costs. You have available the following additional intormation: a) Selling prices, working capital requirements and overhead expenses are expected to increese by 5% per year. b) Material costs and labour costs are expected to increase by 10% per year. c) Capital allowances (tax deduction) are allowed for taxation purposes against protits at 25% per year on a reducing balance basis. d) Taxation of protits is at a rate of 35%, payable in arrears. o) The non-current assets have no expected salvage value at the end of the five years. Assume a scrap value of N\$1 423000 in year 5. f) The company's real after-tax discount rate (or weighted average cost of capital) is eatimated to he 8% per year, and the nominal after-tax discount rate is 15\% per year. Paze 3 ? g) Assume that all receipts and payments arose at the end of the year to which they relate except those in year 01 which occur immediately. Required: 2.1 Estimate the net present value of the proposed project. State clearly any assumptions that you make. (16 marks) 2.2 Calculate by how much the discount rate would have to change to result in a net present value of approximately zero. (4 marks) Question 5 (20 Marks) Blue Wail appointed you as their finarice manager. The compary is considering inveating in the production of an electronic secunty device, with an expected market lite of tive years. The previous finance manager has undertaken an analysis of the proposed project: the main features of this analysis are shown below. All the abeve cash flow and prefit estimates have been prepared in terms of presentday costs and prices, as the previous finance manager assumed that the sales price could be increased to compensate for any increase in costs. You have available the following additional intormation: a) Selling prices, working capital requirements and overhead expenses are expected to increese by 5% per year. b) Material costs and labour costs are expected to increase by 10% per year. c) Capital allowances (tax deduction) are allowed for taxation purposes against protits at 25% per year on a reducing balance basis. d) Taxation of protits is at a rate of 35%, payable in arrears. o) The non-current assets have no expected salvage value at the end of the five years. Assume a scrap value of N\$1 423000 in year 5. f) The company's real after-tax discount rate (or weighted average cost of capital) is eatimated to he 8% per year, and the nominal after-tax discount rate is 15\% per year. Paze 3 ? g) Assume that all receipts and payments arose at the end of the year to which they relate except those in year 01 which occur immediately. Required: 2.1 Estimate the net present value of the proposed project. State clearly any assumptions that you make. (16 marks) 2.2 Calculate by how much the discount rate would have to change to result in a net present value of approximately zero. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts