Question: please provide correct answer to the question in detail. 2. Use a 3-step binomial tree to value a European Call Option with the following conditions:

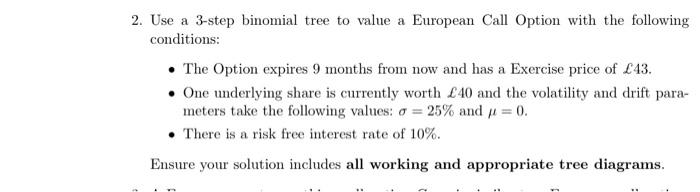

2. Use a 3-step binomial tree to value a European Call Option with the following conditions: The Option expires 9 months from now and has a Exercise price of 43. One underlying share is currently worth 40 and the volatility and drift para- meters take the following values: a = 25% and i = 0. There is a risk free interest rate of 10%. Ensure your solution includes all working and appropriate tree diagrams. 2. Use a 3-step binomial tree to value a European Call Option with the following conditions: The Option expires 9 months from now and has a Exercise price of 43. One underlying share is currently worth 40 and the volatility and drift para- meters take the following values: a = 25% and i = 0. There is a risk free interest rate of 10%. Ensure your solution includes all working and appropriate tree diagrams

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts