Question: PLEASE PROVIDE CORRECT ANSWER WITH ACCURATE EXPLANATION/SOLUTION thank you John Andrei is interested in the stocks of Company A. Before purchasing company the stock, Mr

PLEASE PROVIDE CORRECT ANSWER WITH ACCURATE "EXPLANATION/SOLUTION" thank you

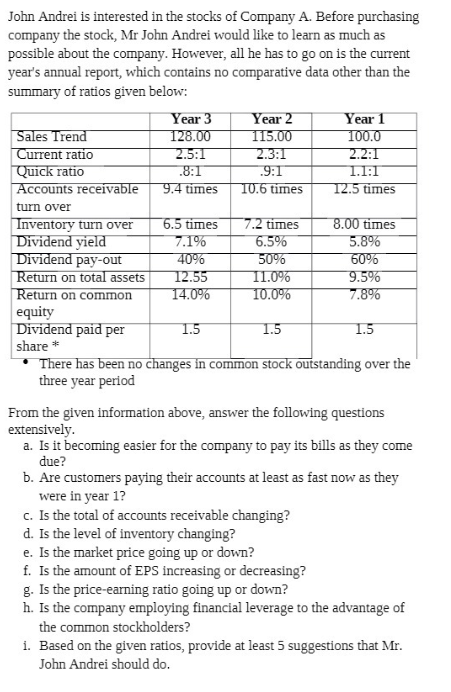

John Andrei is interested in the stocks of Company A. Before purchasing company the stock, Mr John Andrei would like to learn as much as possible about the company. However, all he has to go on is the current year's annual report, which contains no comparative data other than the summary of ratios given below: Year 3 Year 2 Year 1 Sales Trend 128.00 115.00 100.0 Current ratio 2.5:1 2.3:1 2.2:1 Quick ratio .8:1 .9:1 1.1.1 Accounts receivable 9.4 times 10.6 times 12.5 times turn over Inventory turn over 6.5 times 7.2 times 8.00 times Dividend yield 7.1% 6.5% 5.8% Dividend pay-out 40% 50% 60% Return on total assets 12.55 11.0% 9.5% Return on common 14.0% 10.0% 7.8% equity Dividend paid per 1.5 1.5 1.5 share * There has been no changes in common stock outstanding over the three year period From the given information above, answer the following questions extensively. a. Is it becoming easier for the company to pay its bills as they come due? b. Are customers paying their accounts at least as fast now as they were in year 1? C. Is the total of accounts receivable changing? d. Is the level of inventory changing? e. Is the market price going up or down? f. Is the amount of EPS increasing or decreasing? g. Is the price-earning ratio going up or down? h. Is the company employing financial leverage to the advantage of the common stockholders? i. Based on the given ratios, provide at least 5 suggestions that Mr. John Andrei should do. John Andrei is interested in the stocks of Company A. Before purchasing company the stock, Mr John Andrei would like to learn as much as possible about the company. However, all he has to go on is the current year's annual report, which contains no comparative data other than the summary of ratios given below: Year 3 Year 2 Year 1 Sales Trend 128.00 115.00 100.0 Current ratio 2.5:1 2.3:1 2.2:1 Quick ratio .8:1 .9:1 1.1.1 Accounts receivable 9.4 times 10.6 times 12.5 times turn over Inventory turn over 6.5 times 7.2 times 8.00 times Dividend yield 7.1% 6.5% 5.8% Dividend pay-out 40% 50% 60% Return on total assets 12.55 11.0% 9.5% Return on common 14.0% 10.0% 7.8% equity Dividend paid per 1.5 1.5 1.5 share * There has been no changes in common stock outstanding over the three year period From the given information above, answer the following questions extensively. a. Is it becoming easier for the company to pay its bills as they come due? b. Are customers paying their accounts at least as fast now as they were in year 1? C. Is the total of accounts receivable changing? d. Is the level of inventory changing? e. Is the market price going up or down? f. Is the amount of EPS increasing or decreasing? g. Is the price-earning ratio going up or down? h. Is the company employing financial leverage to the advantage of the common stockholders? i. Based on the given ratios, provide at least 5 suggestions that Mr. John Andrei should do

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts