Question: please provide detailed answer for the question step by step previous solved question on chegg is not right please provide right solution to it. kind

please provide detailed answer for the question step by step previous solved question on chegg is not right please provide right solution to it.

kind regards

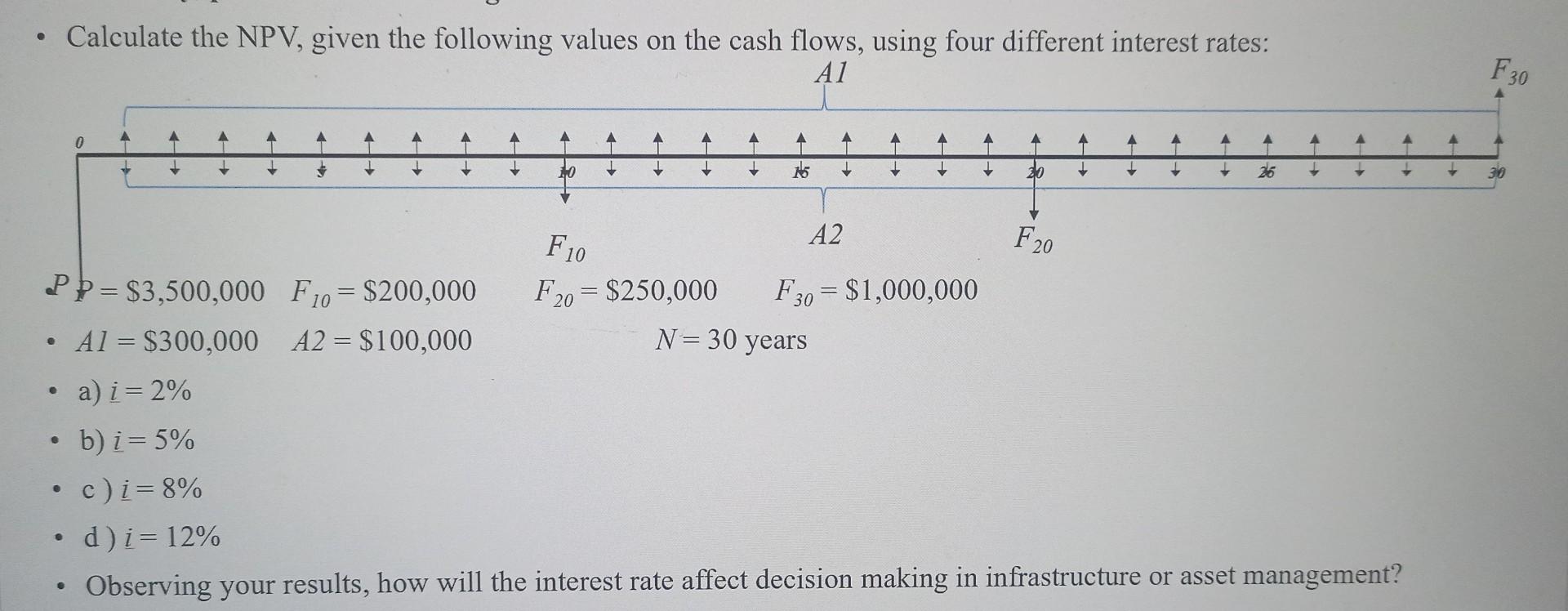

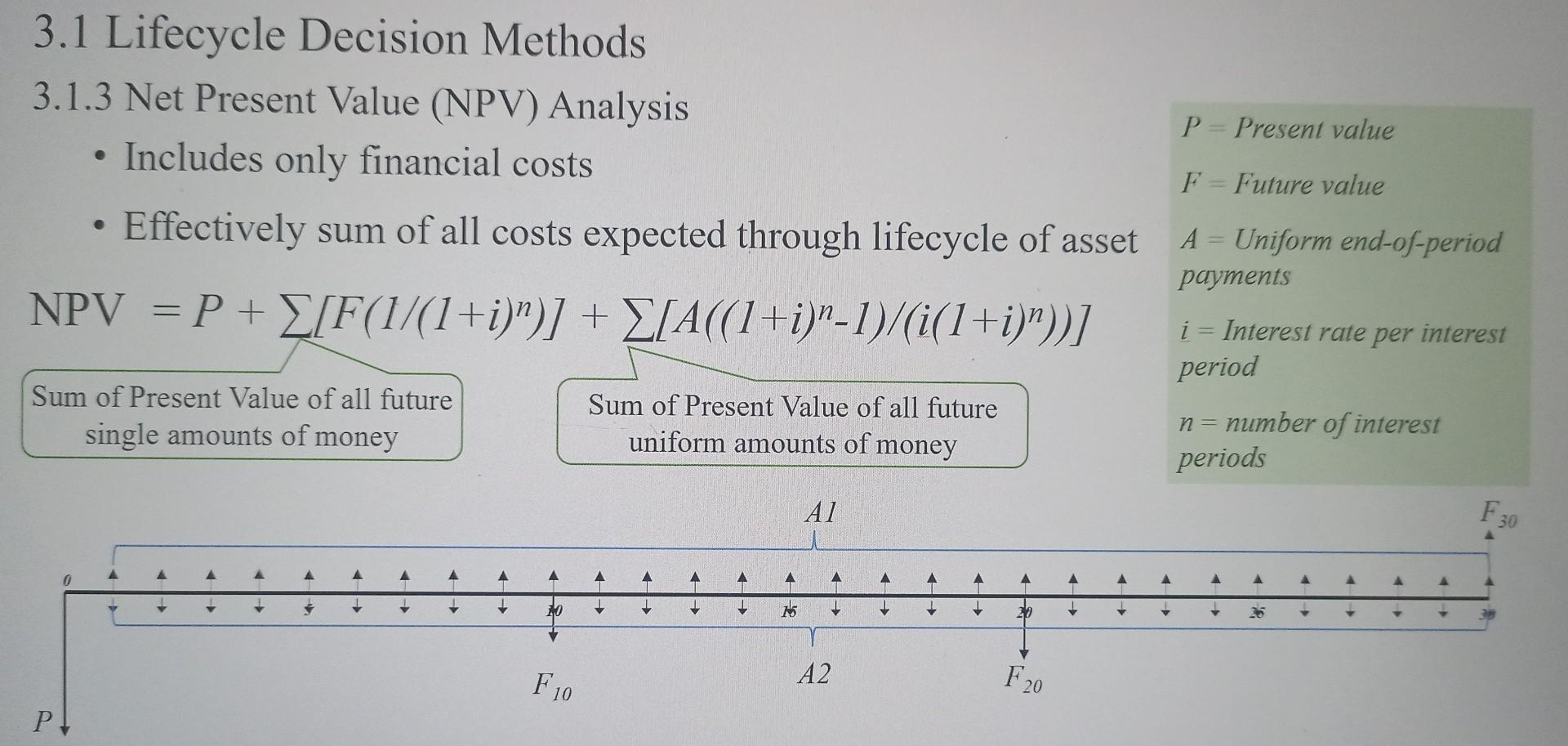

Calculate the NPV, given the following values on the cash flows, using four different interest rates: Al F30 0 A A A A A A A A A 1 A- H 15 10 1 20 26 30 F20 N= 30 years Fjo A2 P= $3,500,000 F10 = $200,000 F20 = $250,000 F30 = $1,000,000 A1 = $300,000 A2 = $100,000 a) i= 2% b) i= 5% C) i=8% d)i= 12% Observing your results, how will the interest rate affect decision making in infrastructure or asset management? . 3.1 Lifecycle Decision Methods 3.1.3 Net Present Value (NPV) Analysis Includes only financial costs Effectively sum of all costs expected through lifecycle of asset P= Present value e F = Future value A - Uniform end-of-period payments NPV = P + [F(1/(1+i)")] + X[A((1+i)n-1)/(i(1+i)"))] i = Interest rate per interest period Sum of Present Value of all future single amounts of money Sum of Present Value of all future uniform amounts of money n = number of interest periods AI F 30 A A A 1 - 2 15 20 FO A2 F 20 P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts