Question: please provide detailed solution. Thanks 1.7 [Adapted from Charnes et al. (1952).] An oil refinery produces four types of raw gasoline: alkylate, catalytic-cracked, straight-run, and

![(1952).] An oil refinery produces four types of raw gasoline: alkylate, catalytic-cracked,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffa513bf015_97066ffa512d6f4d.jpg)

please provide detailed solution. Thanks

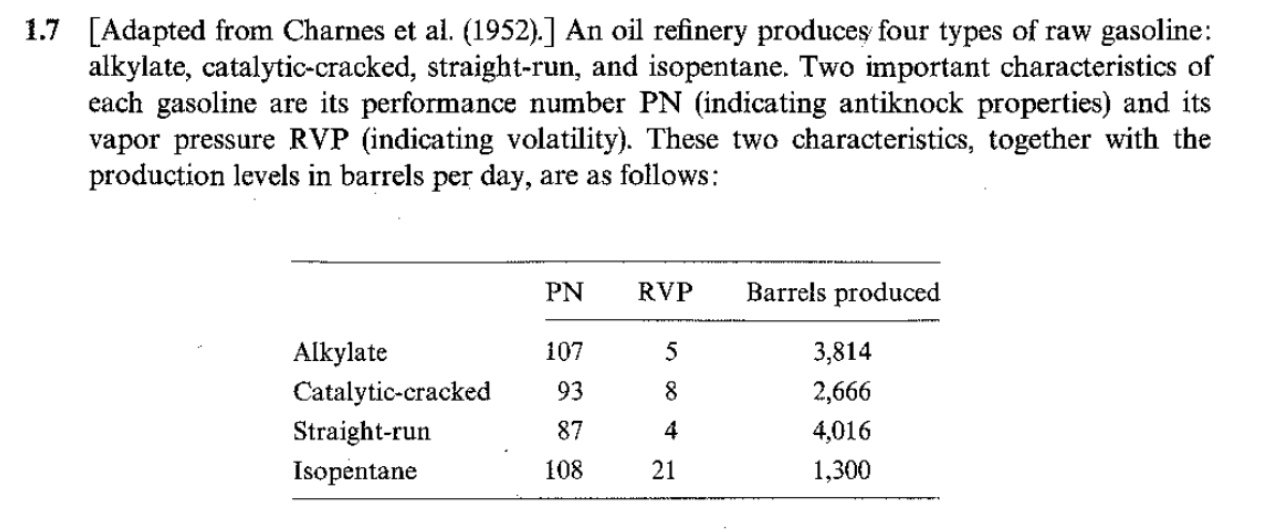

1.7 [Adapted from Charnes et al. (1952).] An oil refinery produces four types of raw gasoline: alkylate, catalytic-cracked, straight-run, and isopentane. Two important characteristics of each gasoline are its performance number PN (indicating antiknock properties) and its vapor pressure RVP (indicating volatility). These two characteristics, together with the production levels in barrels per day, are as follows: PN RVP Barrels produced 107 5 93 8 Alkylate Catalytic-cracked Straight-run Isopentane 3,814 2,666 4,016 1,300 87 4 108 21 These gasolines can be sold either raw, at $4.83 per barrel, or blended into aviation gaso- lines (Avgas A and/or Avgas B). Quality standards impose certain requirements on the aviation gasolines; these requirements, together with the selling prices, are as follows: PN RVP Price per barrei $6.45 Avgas A Avgas B at least 100 at least 91 at most 7 at most 7 $5.91 The PN and RVP of each mixture are simply weighted averages of the PNs and RVPs of its constituents. For example, the refinery could adopt the following strategy: Blend 2,666 barrels of alkylate and 2,666 barrels of catalytic into 5,332 barrels of Avgas A with (2,666 x 107) + (2,666 x 93) PN = 100 5,332 (2,666 x 5) + (2,666 x 8) RVP = 6.5. 5,332 Blend 1,148 barrels of alkylate, 4,016 barrels of straight-run, and 1,024 barrels of iso- pentane into 6,188 barrels of Avgas B with (1,148 x 107) + (4,016 ~ 87) + (1,024 108) PN = 94.2 6,188 (1,148 x 5) + (4,016 X 4) + (1,024 21) RVP = 7. 6,188 Sell 276 barrels of isopentane raw. This sample plan yields a total profit of (5,332 x 6.45) + (6,188 x 5.91) + (276 x 4.83) = $72,296. The refinery aims for the plan that yields the largest possible profit. Formulate as an LP problem in the standard form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts